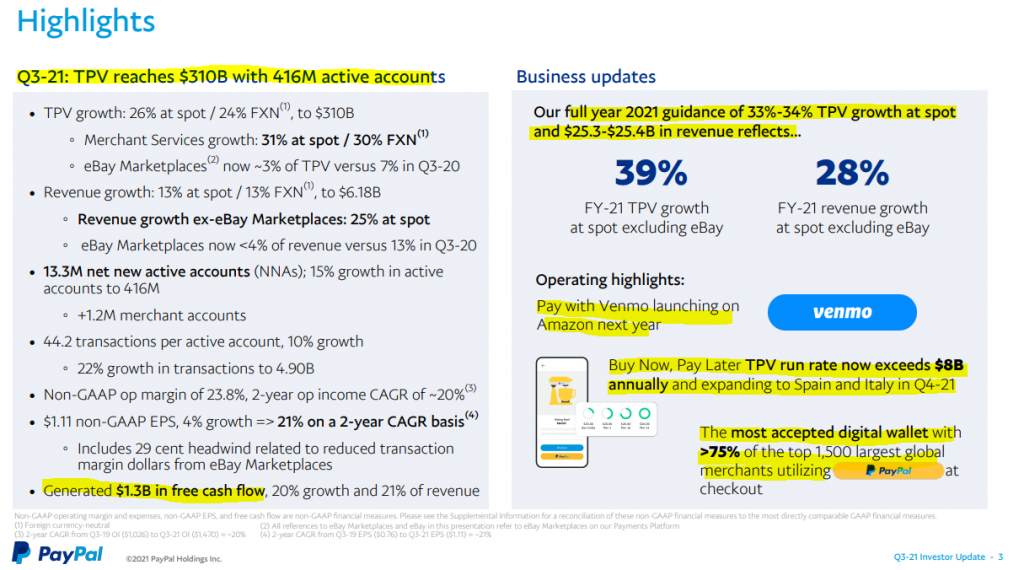

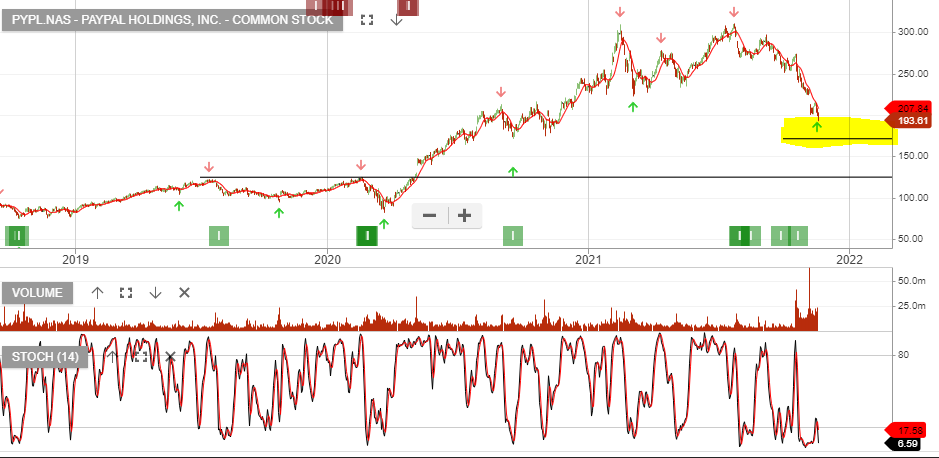

PayPal Holdings, Inc. – Common is a current holding in our US model portfolio. The stock is up 10% since being added last year and the current sell-off provides another entry opportunity.

20/11 update: Paypal remains below the 10-day average and we encourage traders interested in US stocks to track the price action, as a powerful price reversal is likely.

26/11 update:

PayPal is an opportunity to accumulate within the $150 – $180 price range. The selloff reflects a correction in the PE ratio from 80x to 40x and the investment is a bet on continued growth and a responsive reaction from the company to increased competitive threats.

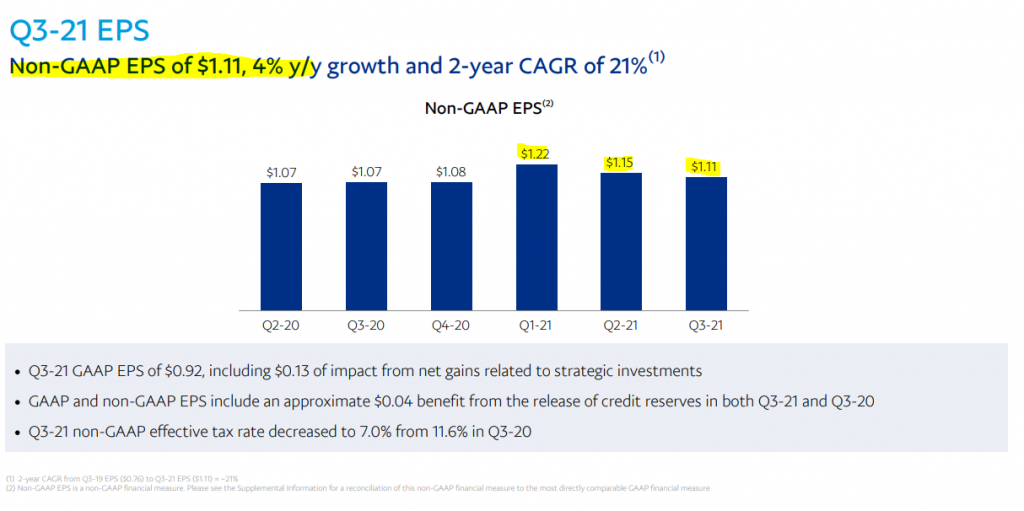

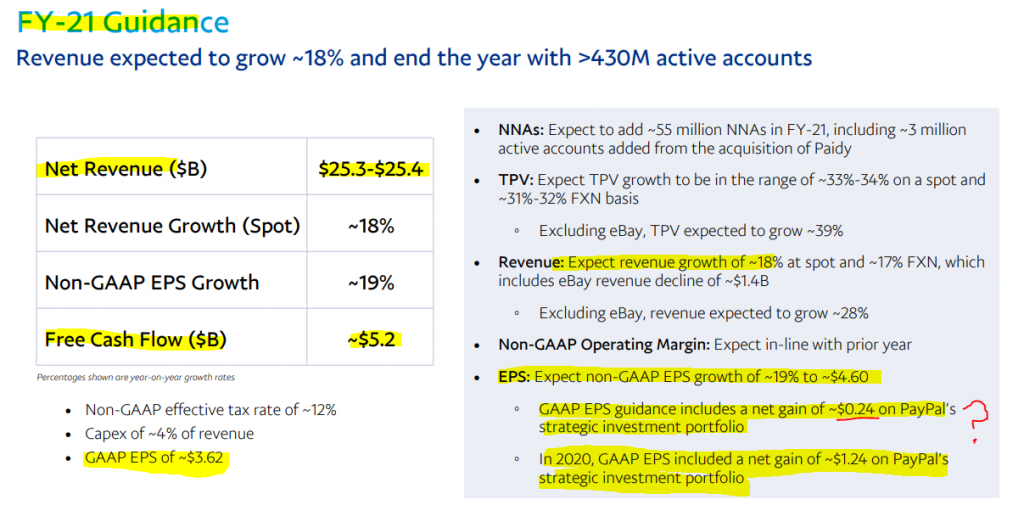

This explains the selloff: 4% EPS growth and the FY21 quarterly trend of lower EPS is a concern. However, we’re positioning on the basis the market is getting overly negative on the stock.

Wait for the price to cross back up through the 10-day average.