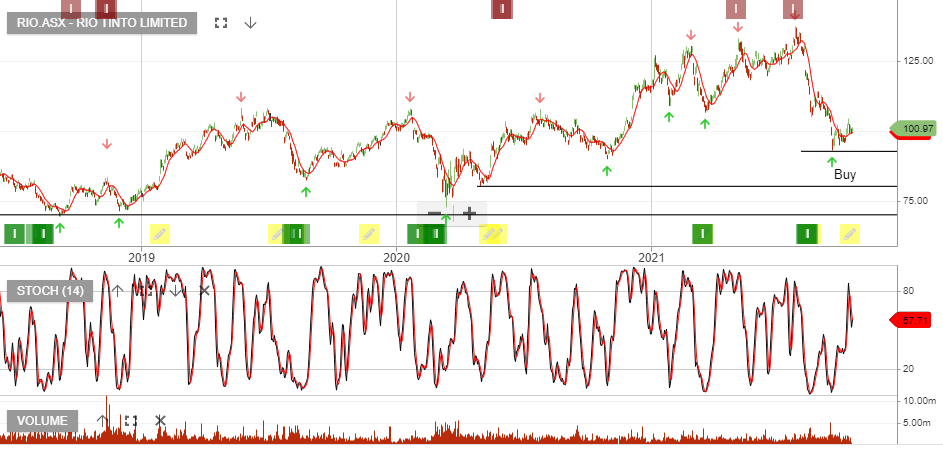

CIMIC – Buy

CIM:ASX is likely to see improved earnings in FY22 and we expect to soon see a recovery in the share price.

CIMIC is a high-risk counter trend investment with the prospect of a multi-year recovery, once earnings hit an inflection point.

Update 21/10: CIMIC Group today announced its financial result for the nine months to 30 September 2021:

NPAT of $303m for 9m of 2021

Group revenue growth of 9.2%2 YoY to $10.9bn, revenue increase of 6.8% YoY to$7.1bn

Revenue growth achieved in Australian Construction and Services

EBITDA, PBT and NPAT margins resilient at 9.6%, 5.1% and 4.3% respectively, despite 3Q21 COVID-19 impact