Northern Star – Buy

Northern Star Resources is under Algo Engine buy conditions and is our preferred gold exposure.

Northern Star Resources is under Algo Engine buy conditions and is our preferred gold exposure.

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

iShares Asia 50 is under Algo Engine buy conditions and is a current holding in our iShares ETF model.

INVESTMENT OBJECTIVE: The fund aims to provide investors with the performance of the S&P Asia 50TM Index, before fees and expenses. The index is designed to measure the performance of the 50 leading companies listed in China, Hong Kong, Macau, Singapore, South Korea and Taiwan.

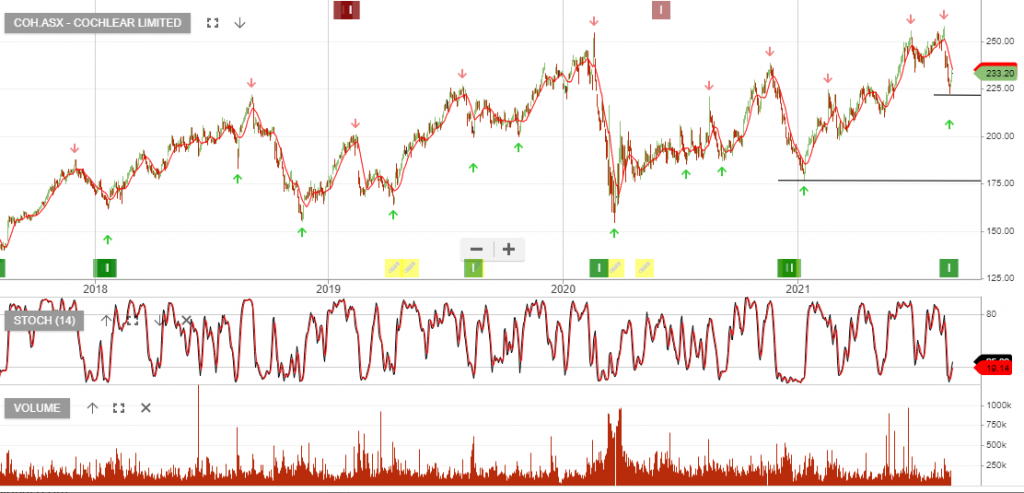

Cochlear is now under Algo Engine buy conditions and has been added to our ASX 100 model portfolio.

We expect 10% EPS growth over the next 12 months. Although, the stock remains expensive at 40x earnings and trading on a 1.8% yield.

Since writing the above post in Dec last year, COH has rallied from $175 to a high of $257. The subsequent pullback which bottomed on Monday this week has seen buying interest rebuild at the higher low of $222.

This is the second cluster of Algo Engine buy signals and we’ve taken the opportunity to add to our original allocation.

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

For our Members, please find below the list of our latest Model Portfolio changes.

Aurizon Holdings is under Algo Engine buy signals.

Aurizon reported underlying earnings before interest taxation depreciation and amortisation (EBITDA) of $1.48 billion and told investors to expect underlying EBITDA of between $1.42 billion-$1.5 billion in fiscal 2022.

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

Wesfarmers is under Algo Engine buy conditions.

FY21 result was slightly above expectations with underlying EBIT up 21% to $3.55bn.

WES has proposed a A$2.3bn (A$2.00 per share) capital return that is expected to be paid in December (subject to shareholder approval).

WES advised that its retail divisions have been affected by recent lockdowns with trading restrictions and several store closures. Any correction in the share price below $60 will offer a buying opportunity.

WES trades on a forward yield of 2.5%.

Bega Cheese is under Algo Engine buy conditions.

The FY21 result beat forecasts on a number of key metrics, with FY21 sales +38%, underlying EBITDA increased +38%, and NPAT up 24%.

FY22 BGA is targeting further earnings growth and to realise the synergies from the LD&D acquisition.

Or start a free thirty day trial for our full service, which includes our ASX Research.