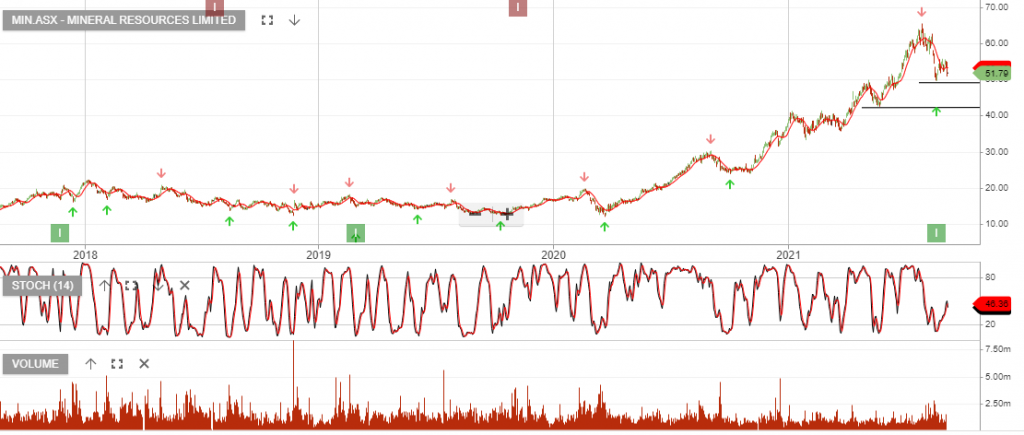

Mineral Resources is under Algo Engine buy conditions and is in our ASX 100 model portfolio.

The share price has fallen 20% from the July high, as the iron ore price rolled over from $220/t to $130/t.

The strong lithium market (particularly spodumene with spot at US$1,250/t) offsets some of the weakness in iron ore and the growth outlook for MIN remains attractive.

The likely approval of Ashburton in the coming months is a key positive for the stock. Key decisions around Ashburton development hub and Wodgina restart are likely at the group AGM scheduled for 18th Nov.

Accumulate within the $42 – $52 price range.