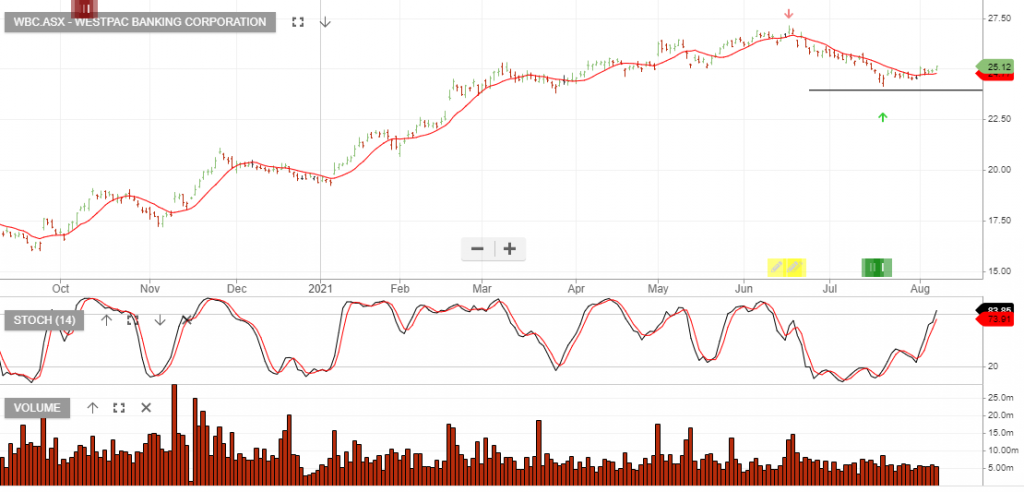

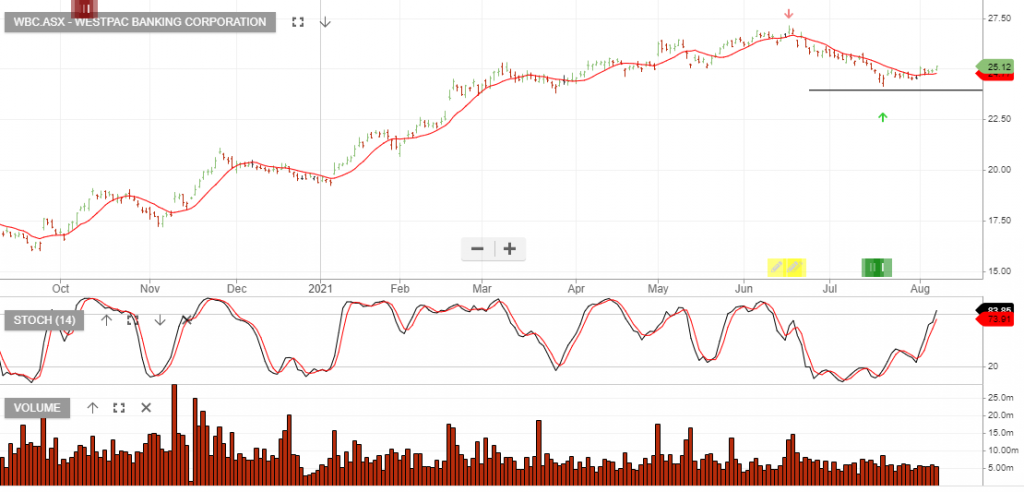

Westpac – Algo Buy

Westpac Banking is under Algo Engine buy conditions and is a current holding in our ASX model portfolio.

Westpac Banking is under Algo Engine buy conditions and is a current holding in our ASX model portfolio.

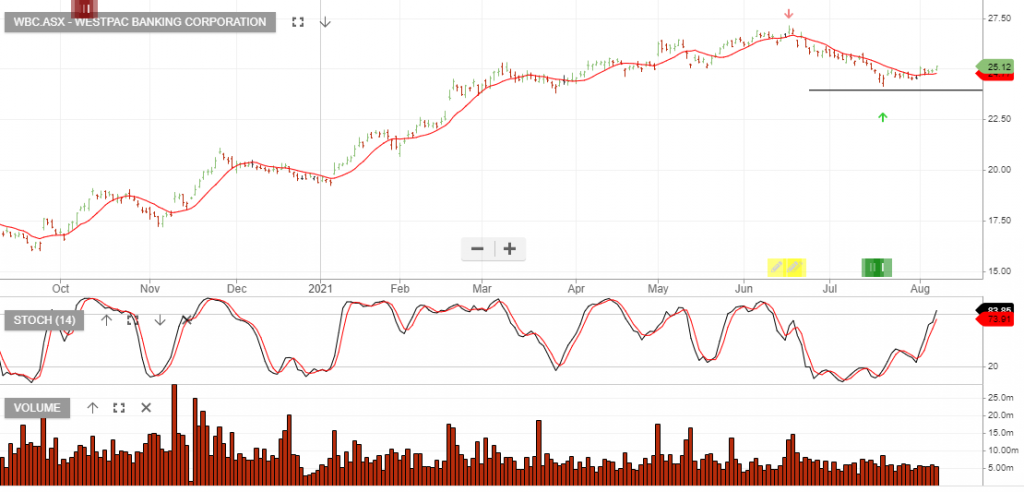

REA Group is under Aglo Engine buy conditions and among the best-performing stocks in our ASX model portfolio. REA was added to the ASX 100 model in September last year at $107.80 and is up 48.40%, (including dividends), to $159.42.

FY21 Revenue increased 13% to $927m and EBITDA increased 19% to $564m. Net Profit After Tax (NPAT) saw a similar lift of 18% to $318m.

The div increases to $0.72 per share and the ex-dividend date is 26 August.

We recommend buying the dip in REA, so please watch for the next Algo Engine buy signal. Long-term earnings growth will be underpinned by the recent acquisition of mortgage broker, Mortgage Choice.

CIM:ASX is likely to see improved earnings in FY22 and we expect to soon see a recovery in the share price.

CIMIC is a high-risk counter trend investment with the prospect of a multi-year recovery, once earnings hit an inflection point.

Buy Dec $20 call options as a stock replacement strategy. For more detail, please call 1300 614 002.

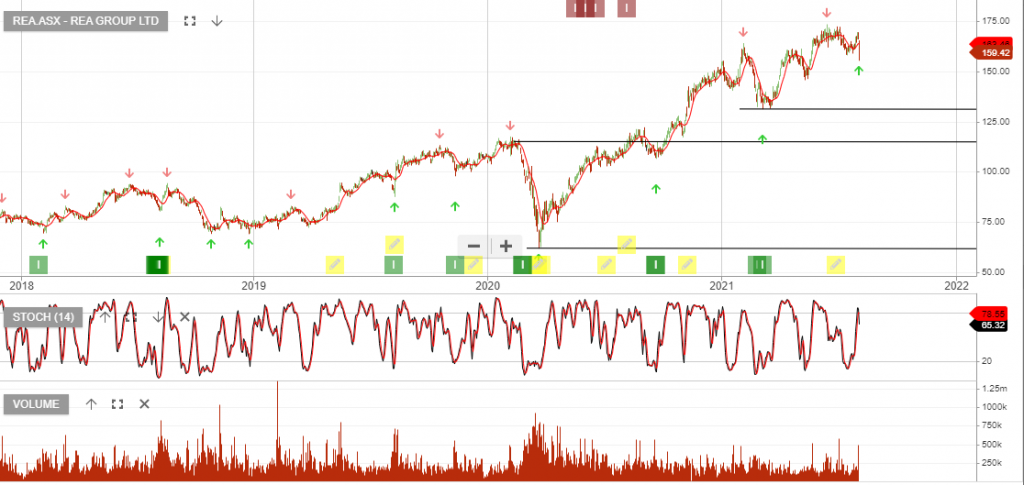

VanEck Australian Banks is under Algo Engine buy conditions, following the entry signal on 20 July. The ETF is now included in our ASX All ETF model.

CBA reports full-year earnings on 11 August, Bendigo full-year earnings due on 16 August, along with quarterly updates from NAB, WBC, and ANZ.

Westpac Banking is under Algo Engine buy conditions and is a current holding in our ASX model portfolio.

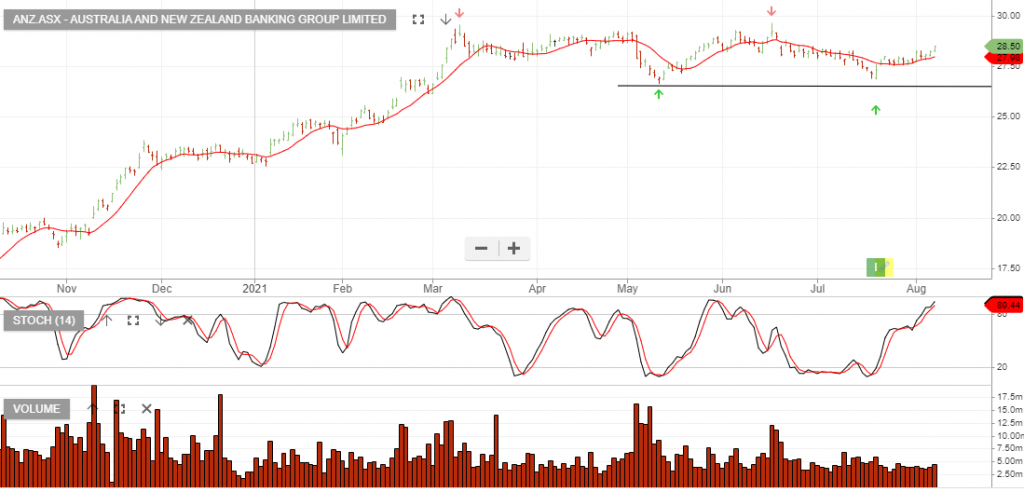

Australia and New Zealand Banking Group is under Algo Engine buy conditions and is a current holding in our ASX model portfolio.

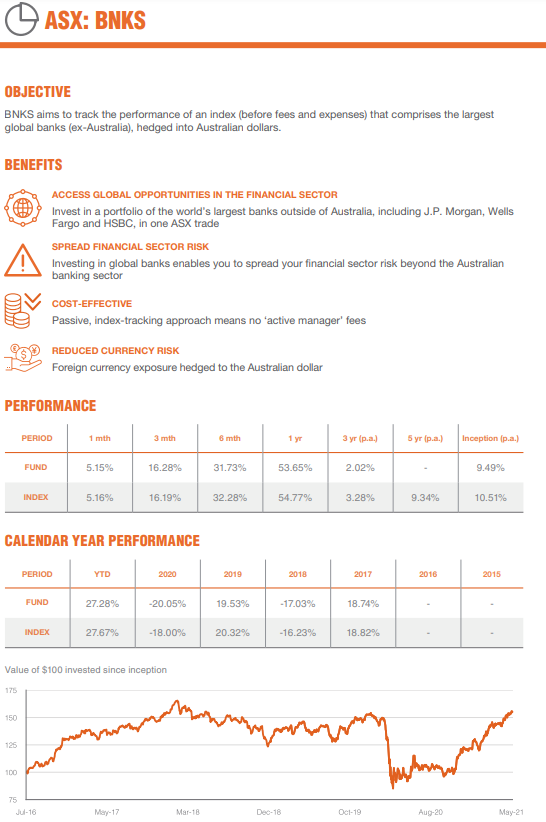

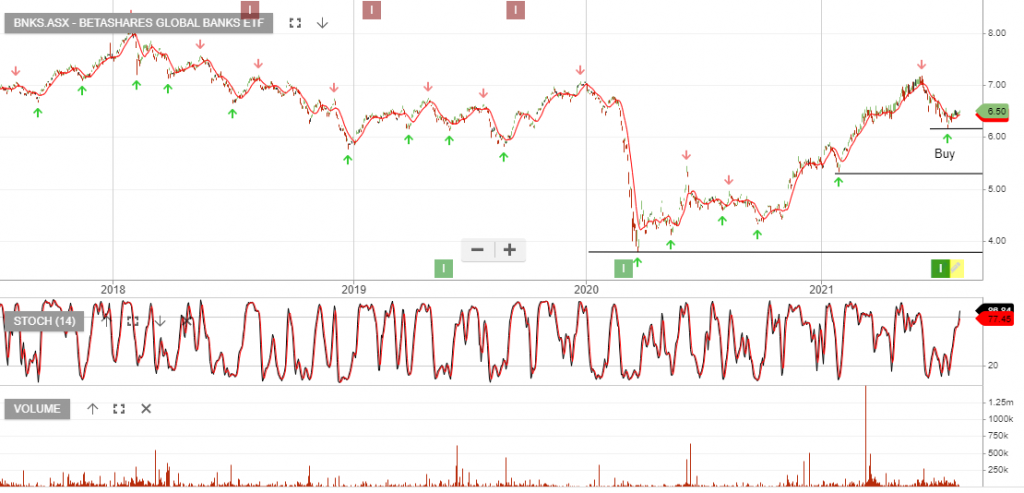

BetaShares Global Banks is now under Algo Engine buy signals and is a current holding in our “ASX All ETF” model.

This is an ASX-listed ETF.

7/8 update: BNKS is now trading $6.50

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

Iron Ore prices are now down 20% from the May peak of US$230 p/t, with the overnight close at US$180 p/t.

We expect buying support to build within the US$150 – US$180 price range. This will provide an entry-level to add to BHP and FMG.

Watch for RIO to soon shift to Algo Engine buy signals.

Insurance Australia Group pre-released guidance and announced its expectations for FY21E cash earnings of A$747mn and guided to low single-digit growth in FY22E.

IAG trades on a forward dividend yield of 3.8%.

Buy IAG with a stop loss @ $4.70

6/8 Update: IAG now trading $5.00

Or start a free thirty day trial for our full service, which includes our ASX Research.