Pointsbet – Algo Buy

Pointsbet Holdings is now under Algo Engine buy conditions and we see buying support building above the $9.30 support level.

Pointsbet Holdings is now under Algo Engine buy conditions and we see buying support building above the $9.30 support level.

Zip Co is under Algo Engine buy conditions and the short-term momentum indicators are now trending higher.

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

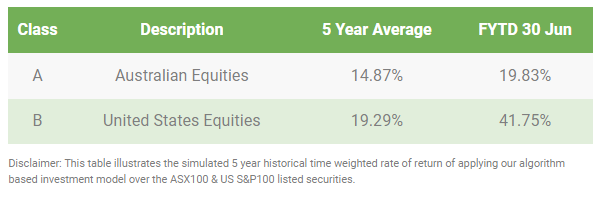

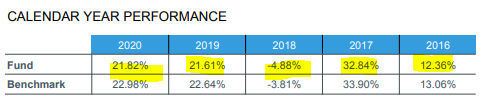

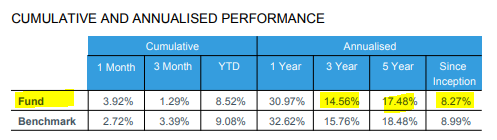

The model portfolio feature is based on the foundation principles of the Investor Signals methodology. The approach is based on over 25 years of market research and industry experience.

Winning trades tend to keep winning and losing trades tend to keep losing. Investors often don’t possess the discipline required to capture the big winners and cut the losers. Our Algo Engine addresses this problem and more than 10 years of testing show consistent outperformance relative to industry benchmarks.

Here’s how it works: When a stock shifts from sell conditions into buy, (a reference to the primary red and green boxes), our Algo Engine adds the stock automatically to the relevant model portfolio. If the stock belongs to one or more of the indexes, it will be added to the relevant lists in the model portfolio tab.

To ensure you get notified of when a stock is added or removed from a model, ensure the envelope beside the list is green, not grey.

A new addition to the model can remain for months or years, or more specifically, until such time as the trend falters and the Algo Engine shifts to sell conditions. The removal or sell instruction will occur on the first sell signal.

It’s possible that a stock that has shifted from sell to a buy signal and has been added to the model will then have multiple subsequent buy signals as the uptrend develops. Investors may wish to add to their original position on each buy signal, however, we do recommend exiting 100% of the position on the first sell signal.

# Always ensure your position size is managed within the confinement of your overall risk strategy.

All our published testing assumes an equal weighting to each signal and no compounding of the position size on subsequent buy signals. We buy on the first buy signal and we sell on the first sell signal.

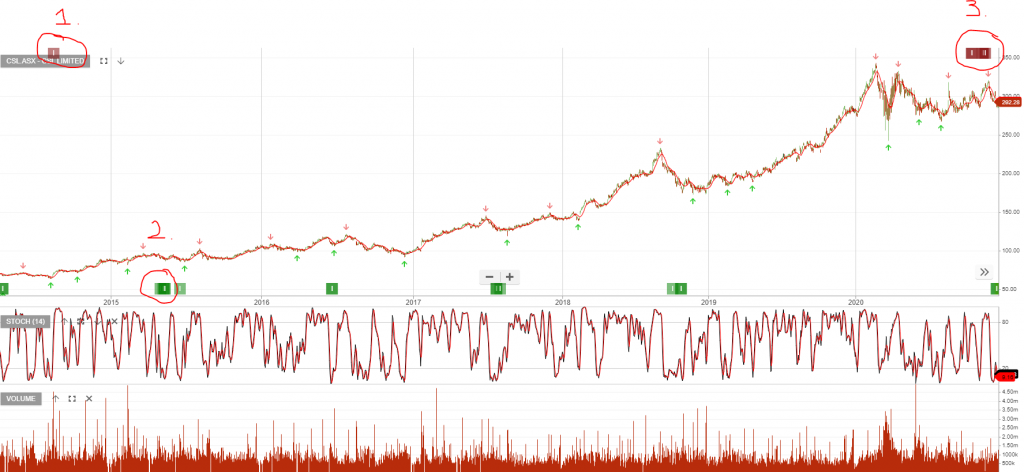

Using CSL as an example.

All dividends are then accumulated and added to the performance of the overall holding. You will note in the CSL example that each retracement within the overall uptrend generated subsequent buy signals, (green boxes).

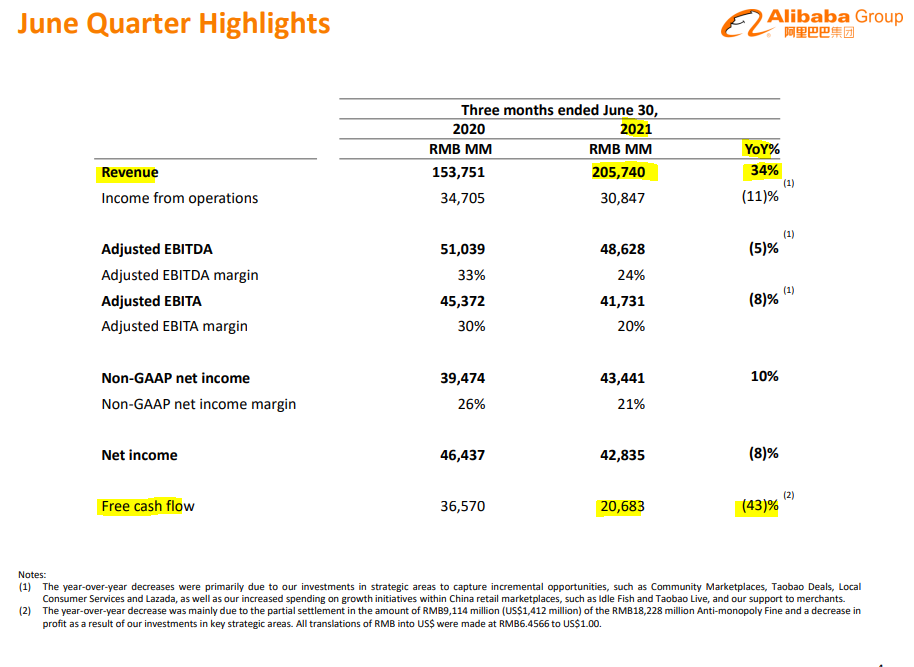

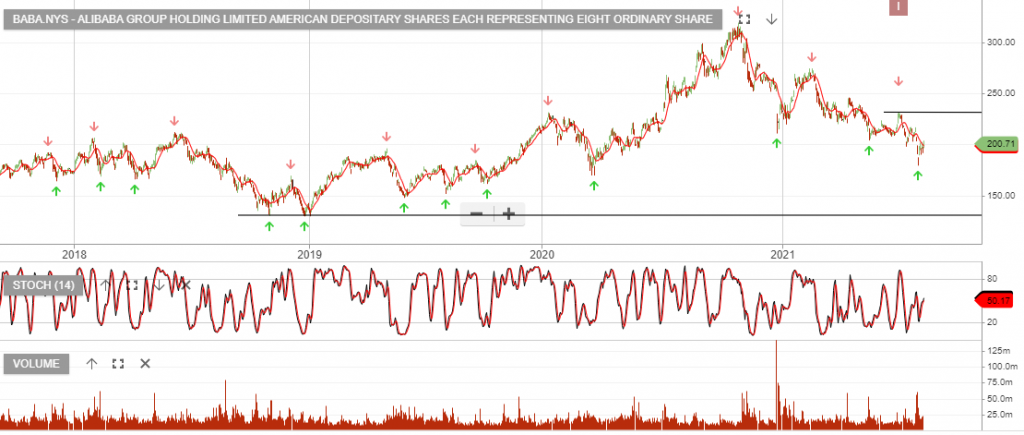

Alibaba Group Holding Limited American Depositary Shares each representing eight Ordinary is finding buying support above the recent $190 low.

We expect the earnings picture to improve over the next 12 months as a result of the regulatory impacts subsiding.

The June result was mixed with strong revenue growth, yet weak free cashflow, relative to the same time last year. We’ll review the September quarter results with interest, looking for an improvement.

iShares Asia 50 is under Algo Engine buy conditions and is a current holding in our iShares ETF model.

INVESTMENT OBJECTIVE: The fund aims to provide investors with the performance of the S&P Asia 50TM Index, before fees and expenses. The index is designed to measure the performance of the 50 leading companies listed in China, Hong Kong, Macau, Singapore, South Korea and Taiwan.

CURE:AXW is under Algo Engine buy conditions and the current pullback provides another buying opportunity.

ETFS S&P Biotech ETF (ASX Code: CURE) offers investors exposure to U.S. biotechnology companies. These companies are engaged in research, development, manufacturing and/or marketing of products based on genetic analysis and genetic engineering.

.

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

SPDR S&P/ASX 200 Listed Property in under Algo Engine buy conditions since February at $11.30 and In July we’ve seen a further buy signal at $12.50.

SLF provides a basket trade with diversification across the REIT sector. SLF and GMG remain our preferred property allocations.

Zip Co is under Algo Engine buy conditions and the short-term momentum indicators are now trending higher.

Or start a free thirty day trial for our full service, which includes our ASX Research.