Call Options Jump 40%

Following a better 1H21 earnings result for CIMIC, the Dec $20 call options increased 40%.

We continue to see CIMIC as a recovery opportunity, supported by an improving balance sheet and increasing work in hand.

Following a better 1H21 earnings result for CIMIC, the Dec $20 call options increased 40%.

We continue to see CIMIC as a recovery opportunity, supported by an improving balance sheet and increasing work in hand.

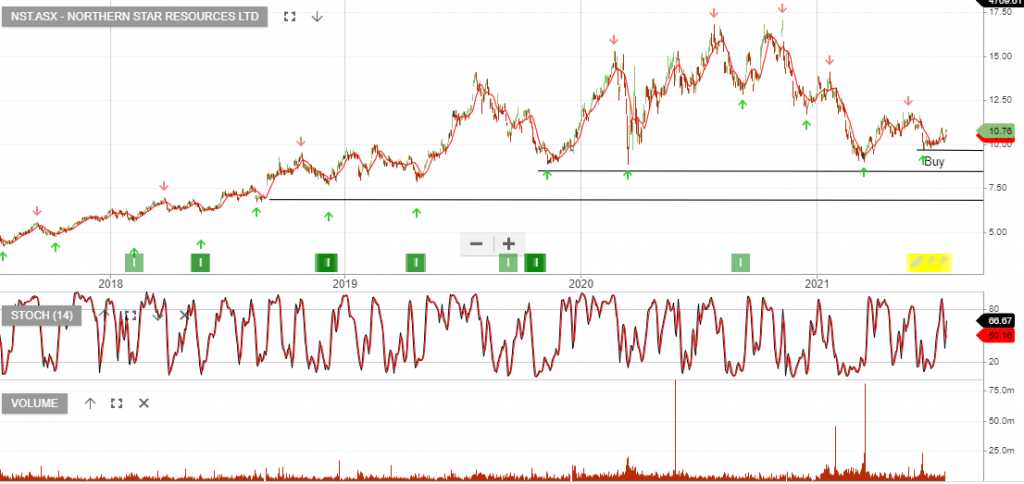

Northern Star Resources is under Algo Engine buy conditions and is our preferred gold exposure.

NST continues to deliver strong results in the June quarter. Group production finished with 450koz at $1460oz, (up 23%), whilst seeing costs come down almost 10%.

We continue to see the twin factors of a strong gold price and cost-saving, (post-merger with SAR), helping to support the share price.

Buy NST

The $400 million placement was at $3.85. The funds raised were to acquire Kundana Gold in Western Australia’s Kalgoorlie region and associated projects from Northern Star.

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

Beach Energy reported quarterly production which was below estimates but reiterated EBITDA guidance for the year to be at the top end of A$850-$900 million range.

Company growth projects remain on track and should see added shareholder value in FY22 and FY23.

Spire shareholders reject acquisition by Ramsay, with 69.9% of votes in favour, thus falling short of the minimum 75% threshold required for the transaction to complete.

Ramsay FY22 revenue is forecast to be $14bn, EBITDA up 8% to $2.3bn, supporting a forward yield of 2.4%.

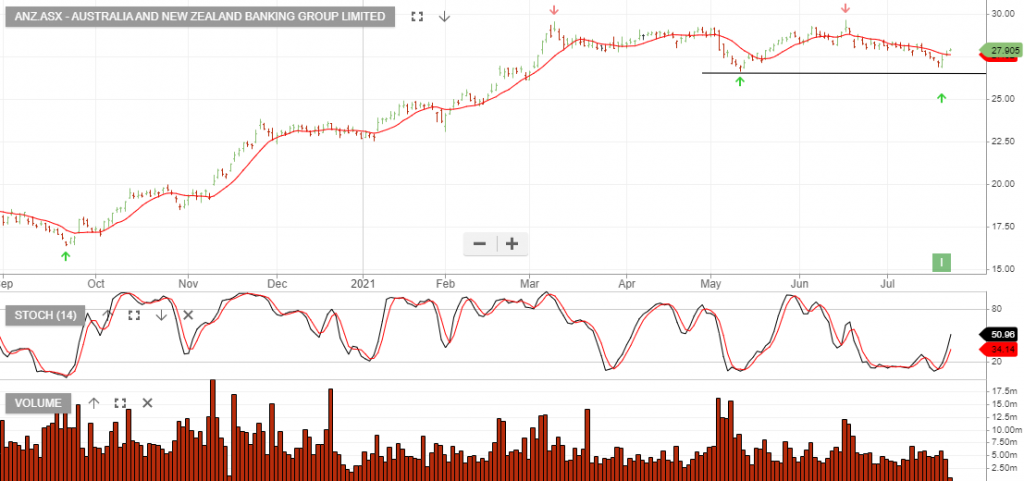

Australia and New Zealand Banking Group is under Algo Engine buy conditions.

ANZ has announced an on-market share buyback program of up to $1.5bn commencing in August. This should provide investors with increased confidence in the strength of major bank balance sheets.

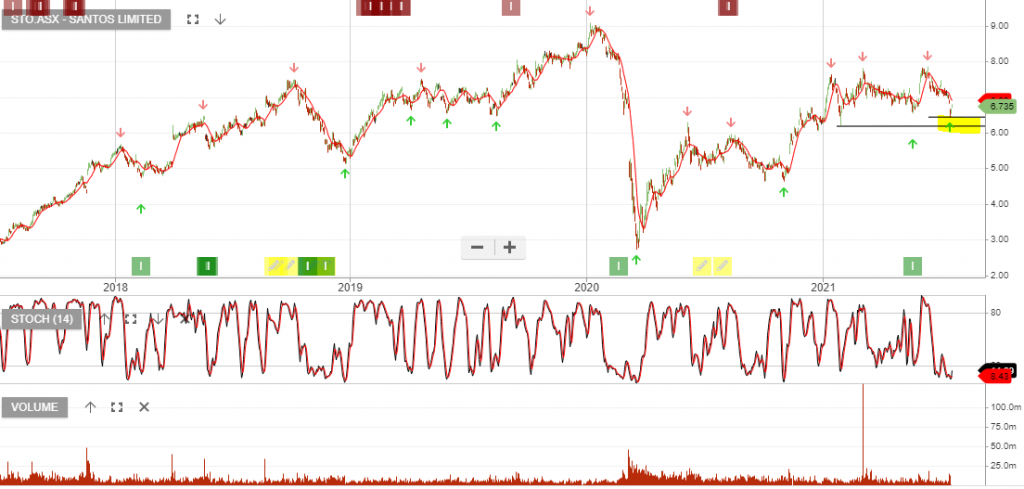

Santos announced it had submitted a non-binding all-scrip merger proposal to Oil Search, under which OSH shareholders would receive 0.589 STO shares for each OSH share.

Currently values OSH at around A$4.25ps.

The new entity will become the largest ASX listed oil and gas company by

market cap.

SPDR S&P/ASX 200 Listed Property in under Algo Engine buy conditions since February at $11.30. This week we’ve seen a further buy signal on the recent pullback to $12.50.

The SLF provides a basket trade with diversification across the REIT sector. SLF and GMG remain our preferred property allocations.

Cimic Group 1H21 earnings beat market expectations, with group revenue growth of 10.6%2 to $7.1bn and NPAT of $208m for HY21.

Factoring balance further reduced by $243m YTD from $976m at December 2020 to $733m at June 2021. 10.4bn of new work awarded in HY21, with total work in hand increasing to $33.3bn.

FY21 NPAT guidance of $400m-$430m maintained, subject to market conditions.

Or start a free thirty day trial for our full service, which includes our ASX Research.