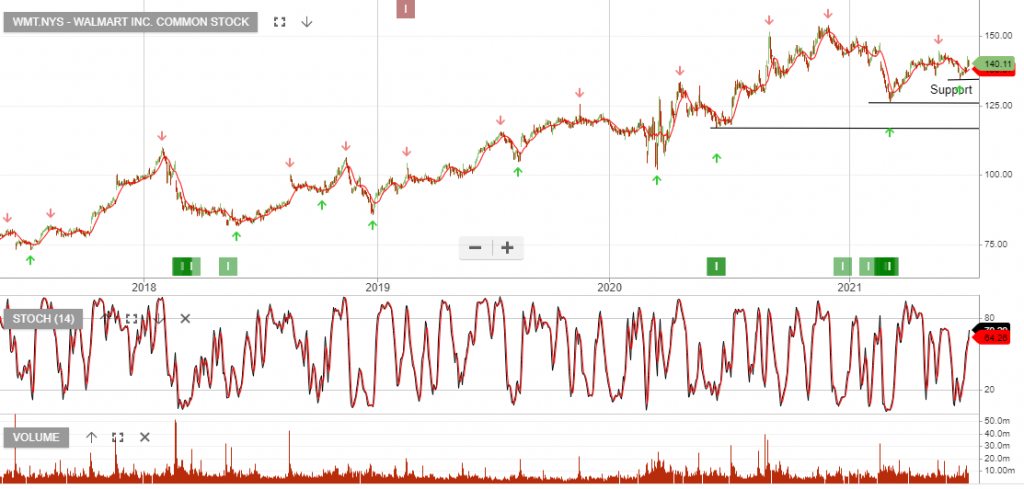

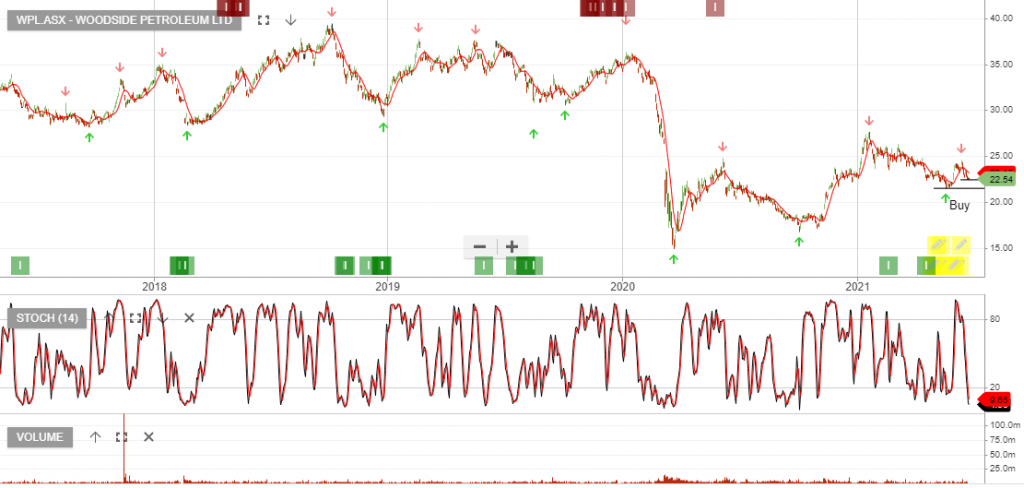

Walmart – Algo Buy

Walmart Inc. Common is under Algo Engine buy conditions.

We’re increasing our exposure to Walmart heading into the June quarter earnings result.

Walmart Inc. Common is under Algo Engine buy conditions.

We’re increasing our exposure to Walmart heading into the June quarter earnings result.

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

For our Members, please find below the list of our latest Model Portfolio changes.

REA Group is among the best-performing stocks in our ASX 100 model portfolio, with the share price up 57% since being added in September last year.

REA Group has acquired 100 percent of the shares in Mortgage Choice for $1.95 a share, valuing the company at $244 million. REA is now focused on accelerating its financial services strategy to become a leading player in the home loan market.

REA is a high quality business with terrific growth potential, however, the 65x PE multiple is a little rich and we recommend waiting for the next Algo Engine buy signal.

Lendlease has issued a profit warning indicating statutory profit after tax of $200 – $320 million, blaming the interruptions caused by the coronavirus, which have hit rents and development activity in London especially hard.

The group’s balance sheet remains strong with gearing expected to be below the bottom end of the target range of 10-20%.

The current weakness in the Crown share price could be a buying opportunity. It’s unlikely that the current COVID-related operational impacts are going to deter the interested parties who have put forward takeover offers.

CURE:AXW is under Algo Engine buy conditions and the current pullback provides another buying opportunity.

ETFS S&P Biotech ETF (ASX Code: CURE) offers investors exposure to U.S. biotechnology companies. These companies are engaged in research, development, manufacturing and/or marketing of products based on genetic analysis and genetic engineering.

.

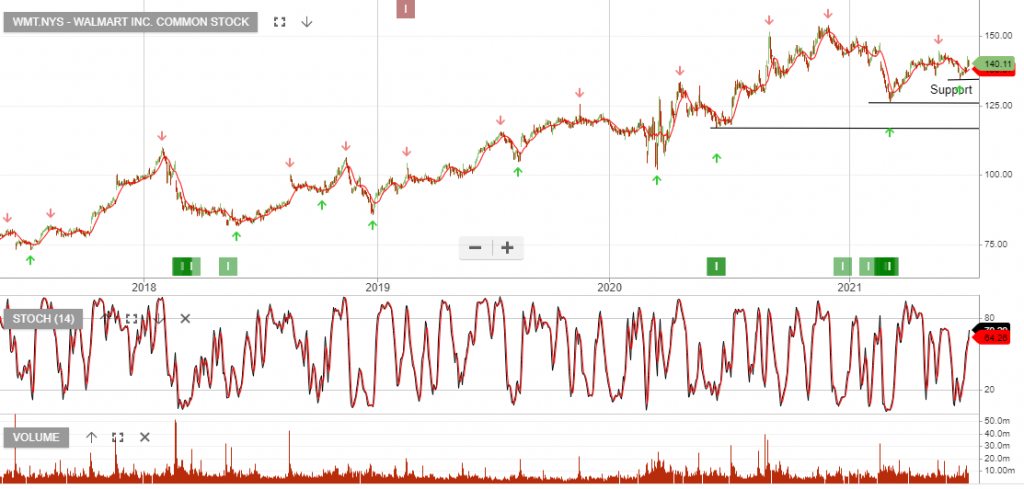

Amcor has guided towards 10 – 14% EPS growth which is attractive for a relatively defensive business.

We expect buying interest to build above the recent $15.00 support level.

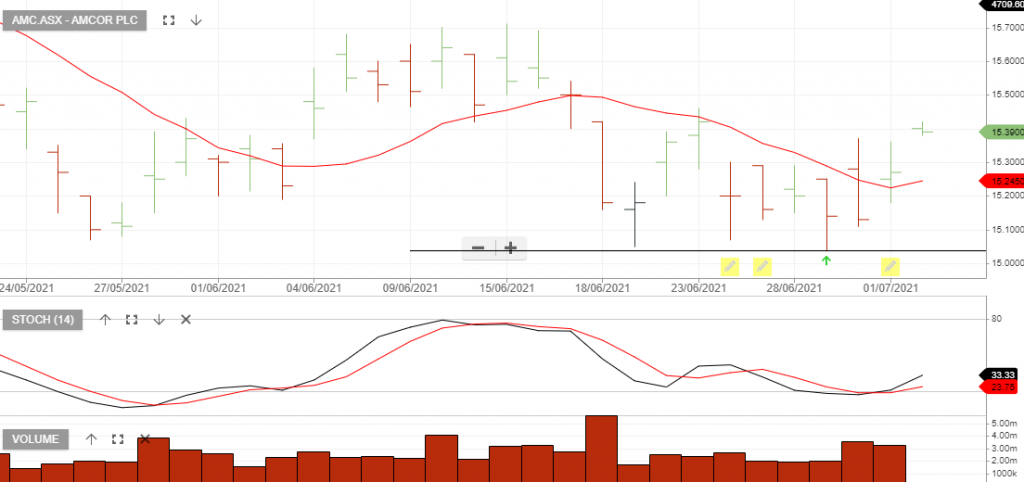

WPL:ASX is under Algo Engine buy conditions and is a current holding in our ASX model portfolio.

The recent pullback and higher low at $22.50 provide another opportunity to buy the stock.

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

Or start a free thirty day trial for our full service, which includes our ASX Research.