These are our Recent Model Changes

For our Members, please find below the list of our latest Model Portfolio changes.

For our Members, please find below the list of our latest Model Portfolio changes.

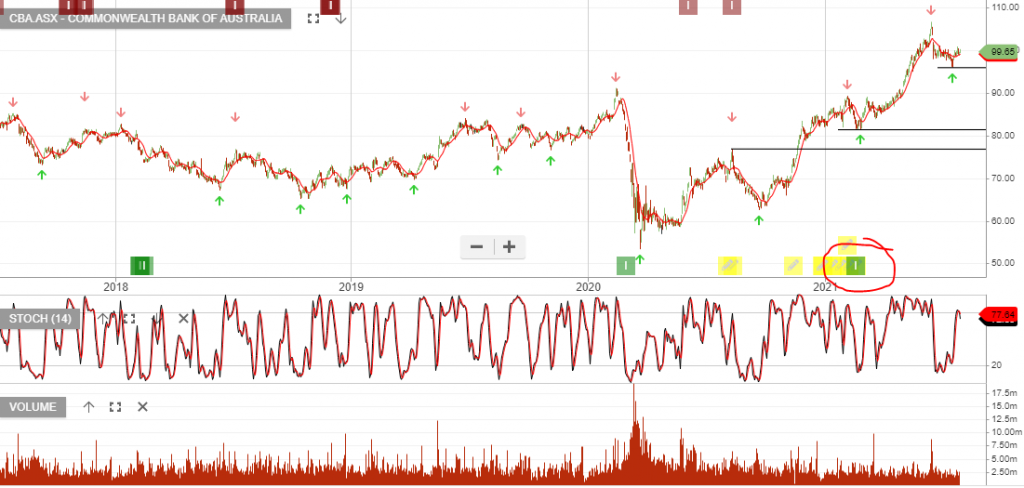

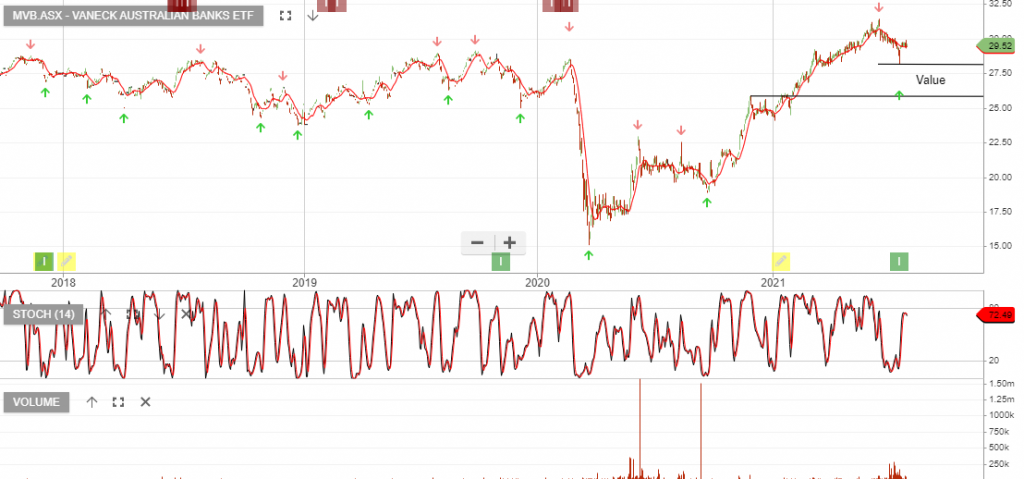

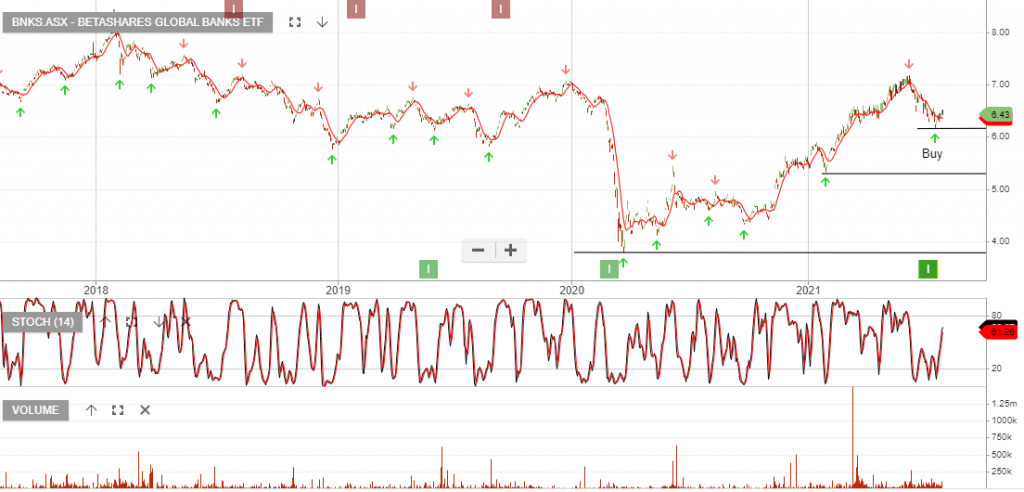

NAB has announced a $2.5bn on-market buyback, which is expected to start in mid to late August 2021.

We expect CBA to launch a $5bn off-market buyback at its FY21 result in August.

The current weakness in the Crown share price could be a buying opportunity. It’s unlikely that the current COVID-related operational impacts are going to deter the interested parties who have put forward takeover offers.

Continue to track the CWN share price and wait for a cross above the 10-day average.

Link Administration Holdings is now under Algo Engine buy conditions and we view $4.80 as an attractive price to begin accumulating the stock.

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

For our Members, please find below the list of our latest Model Portfolio changes.

Gold Road Resources is now under Algo Engine buy conditions.

Gold Road anticipates gold production for the 2021 calendar year will be within the lower half of guidance (260,000 to 300,000 ounces on a 100% basis).

AISC for the 2021 calendar year is anticipated to be between $1,325 and $1,475 per attributable ounce, with lower June 2021 quarter production and higher maintenance and labour costs the main contributors to an increase from the guidance of between A$1,225 – A$1,350.

FY21 revenue forecast is for $300mil generating EBIT of $100mil.

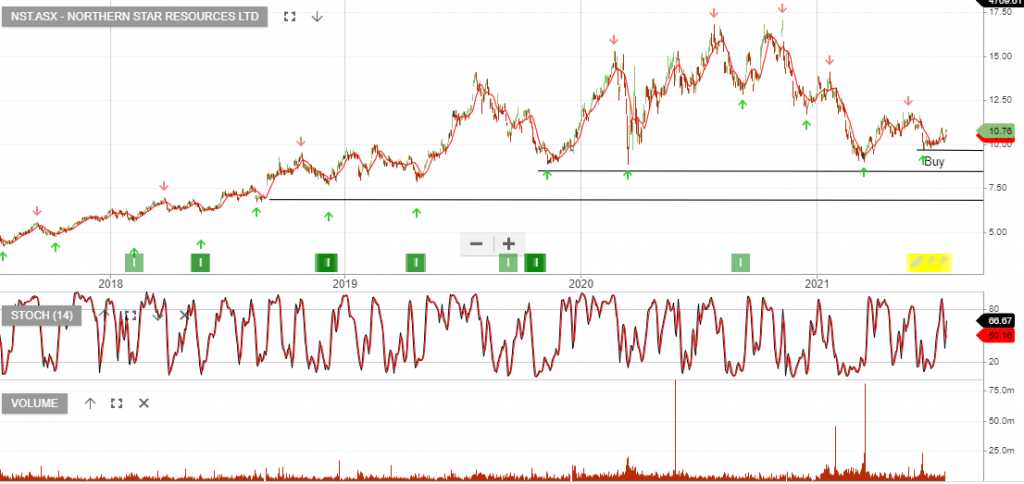

Northern Star Resources is under Algo Engine buy conditions and is our preferred gold exposure.

NST continues to deliver strong results in the June quarter. Group production finished with 450koz at $1460oz, (up 23%), whilst seeing costs come down almost 10%.

We continue to see the twin factors of a strong gold price and cost-saving, (post-merger with SAR), helping to support the share price.

Buy NST

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

For our Members, please find below the list of our latest Model Portfolio changes.

Or start a free thirty day trial for our full service, which includes our ASX Research.