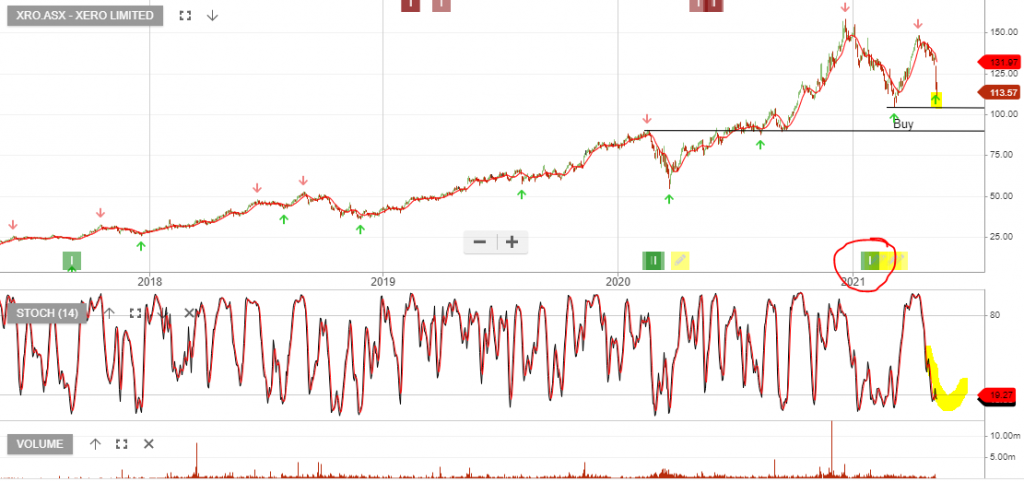

Xero is under Algo Engine buy conditions and is a current holding in our ASX 100 model.

The high EBITDA margins reported in the 1H appear to be a one-off due to lower constrained operating costs during COVID. The sell-off in XRO share price following the FY21 result is reflective of the market recalibrating the growth rate.

A normalization of operating margins will likely be more in the 16 – 18% range rather than the near 30% reported in the first half results.

We continue to see solid revenue growth and are comfortable buying XRO on or near our support range.