These are our Recent Model Changes

For our Members, please find below the list of our latest Model Portfolio changes.

For our Members, please find below the list of our latest Model Portfolio changes.

Brambles Limited today reported sales revenue from continuing operations of US$3,794.1 million for the first nine months of the financial year ending 30 June 2021 (FY21), representing an increase of 8% at actual FX rates on the prior corresponding period.

BXB are on track to deliver FY21 sales, earnings and cash flow guidance, representing EBIT growth between 5 – 7%.

We see scope for BXB to trade back to $11 – $12.

ASX:IZZ is under Algo Engine buy conditions. We expect buying interest to increase near the $60 support level.

Buy IZZ at market.

WPL:ASX is under Algo Engine buy conditions and is a current holding in our ASX model portfolio.

CURE:AXW is under Algo Engine buy conditions and the current pullback provides another buying opportunity.

ETFS S&P Biotech ETF (ASX Code: CURE) offers investors exposure to U.S. biotechnology companies. These companies are engaged in research, development, manufacturing and/or marketing of products based on genetic analysis and genetic engineering.

.

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

For our Members, please find below the list of our latest Model Portfolio changes.

SGM:ASX is under Algo Engine buy conditions and has rallied 30% since the entry signal in February.

The trading update was positive with FY21 EBIT guidance of $260 – $310m. We expect continued earnings strength in FY22.

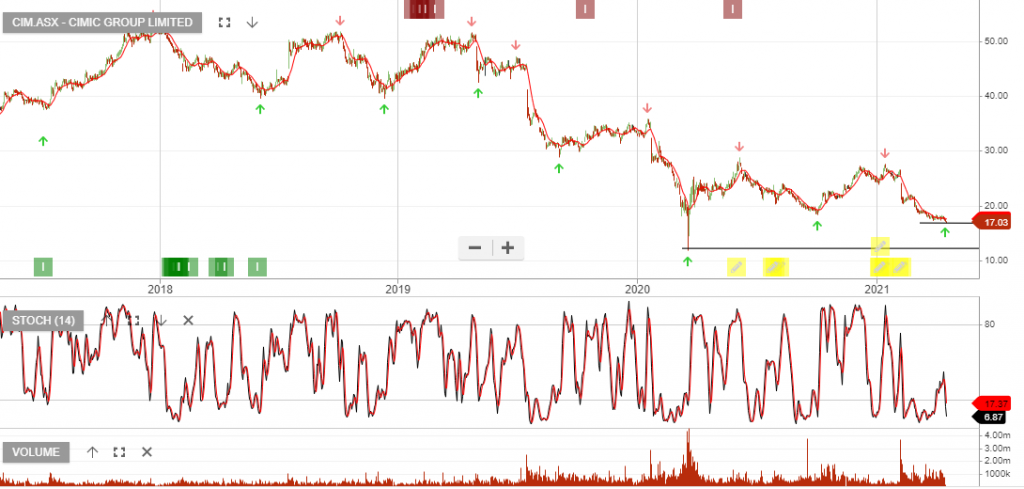

Notes from: EXECUTIVE CHAIRMAN AND CHIEF EXECUTIVE OFFICER’S ADDRESS TO SHAREHOLDERS

The past year once again showed our diversified business model is resilient and enables us to adapt to market changes. Despite the challenges of the pandemic, we achieved positive results.

Revenue was $11.4 billion, with COVID causing a temporary delay in the award of new projects and slowdown of revenues across our activities.

We delivered a statutory net profit after tax of $620 million, with an underlying NPAT of $601 million.

Our statutory margins remained solid at 10.3% for earnings before interest and tax, 8.7% for profit before tax and 5.4% for NPAT.

An important milestone for 2020 was the completion of the sale of 50% of Thiess. This allowed us to capitalise on Thiess’ strong performance and positive outlook, while retaining a strategic interest in the

sector.

Thiess continues to be core to our business. Co-ownership is functioning seamlessly, and we and our partner are very much aligned on operational decisions and growing the business.The sale generated a post-tax gain of $1.4 billion, Net cash proceeds were $2.1 billion which enables us to strengthen our balance sheet, reduce debt and pursue future growth opportunities.

Ventia also completed the acquisition of Broadspectrum in 2020, forming one of the largest infrastructure services companies in Australia and New Zealand. With a positive industry outlook, and given the expanded size of the business, we continue assessing our strategic options for our investment in Ventia.

In 2020, one-off post tax impacts included an $805 million non-cash loss on the Gorgon Jetty arbitration. Other items of $613 million related to COVID, project settlements, provisions, property business writedowns and oil & gas vessel impairments.

RIO:ASX is under Algo Engine buy conditions and is a current holding in our model portfolio.

1Q21 – lower volumes were offset by higher prices in iron ore and aluminum. We remain mindful of the increased commentary in the market where analysts are forecasting a peak in the strong fundamentals which have supported iron ore prices.

FY22 div yield for RIO is tracking at 5.5% to 7%, subject to iron ore prices within a range of $130 – $160 p/t.

Note: The spot price of iron ore rose to $US189 a tonne on Tuesday.

Or start a free thirty day trial for our full service, which includes our ASX Research.