These are our Recent Model Changes

For our Members, please find below the list of our latest Model Portfolio changes.

For our Members, please find below the list of our latest Model Portfolio changes.

CIM:ASX is likely to see improved earnings in FY22 and we expect to soon see a recovery in the share price.

CIMIC is a high risk counter trend investment with the prospect of a multi-year recovery, once earnings hit an inflection point.

24/4 CIMIC breaks above the 10-day average after forming a new trend low mid-week at $16.86.

WPL:ASX is under Algo Engine buy conditions and is a current holding in our ASX model portfolio.

CURE:AXW is under Algo Engine buy conditions and the current pullback provides another buying opportunity.

ETFS S&P Biotech ETF (ASX Code: CURE) offers investors exposure to U.S. biotechnology companies. These companies are engaged in research, development, manufacturing and/or marketing of products based on genetic analysis and genetic engineering.

.

ASX:IZZ is under Algo Engine buy conditions. We expect buying interest to increase near the $60 support level.

Buy IZZ at market.

DOW:ASX is now under Algo Engine buy conditions. The company has guided towards double-digit earnings growth into FY22 & FY23.

24/4 Downer EDI has found support and buying interest has increased above $5.00.

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

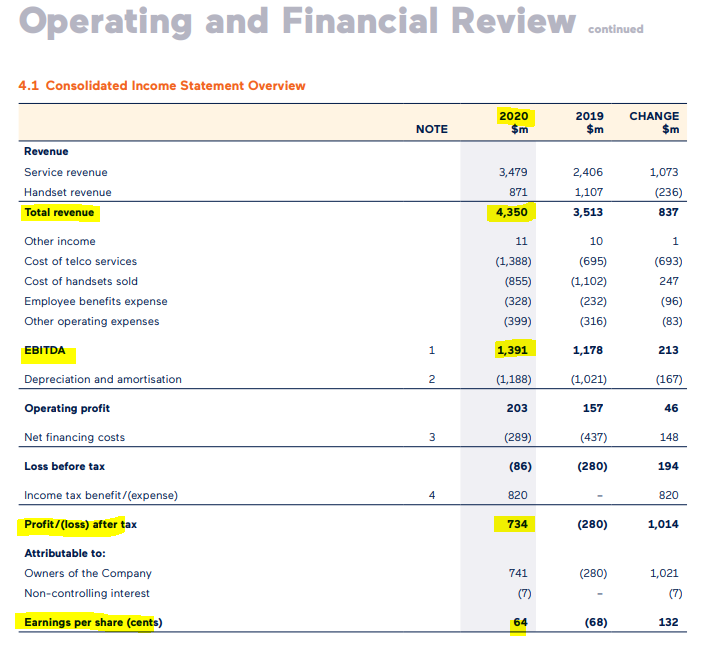

As the merger was effective for accounting purposes from 26 June 2020, TPG Telecom’s reported results for 2020 include a full twelve months of TPG Telecom Limited (formerly named VHA) and a contribution of six months and four days from TPG Corporation Limited (formerly named TPG Telecom).

Reported revenue for the year increased 24% from 2019 to $4.35 billion and reported EBITDA increased by 18% to $1.39 billion. We reported NPAT of $734 million, which includes a one-off, non-cash credit to income tax expense of $820 million.

In the first six months post-merger, the Group has generated $342 million

of net cash flow. The TPG Telecom Board resolved to pay a final dividend for 2020 of 7.5 cents per share.

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

Or start a free thirty day trial for our full service, which includes our ASX Research.