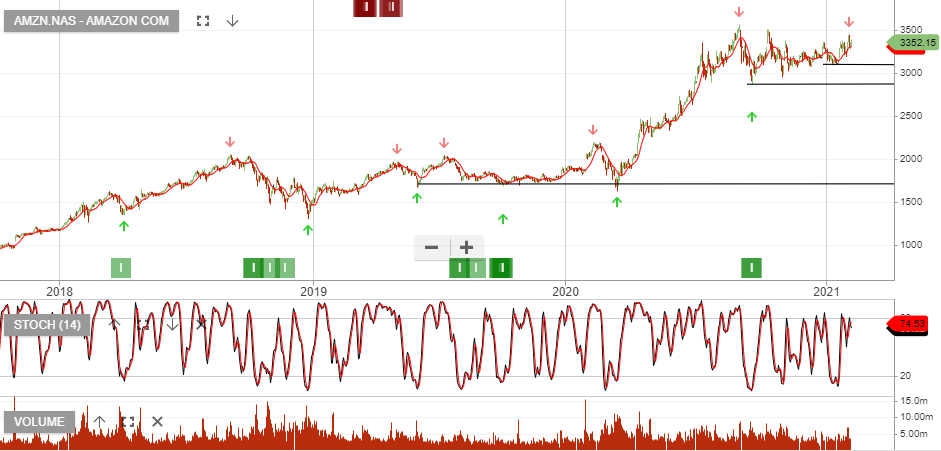

Amazon – Up 88%

AMZN:NAS is under Algo Engine buy conditions and is up 88% since being added to our US S&P100 model portfolio on 1/8/2019.

For the December quarter, AMZN posted record revenues of more than $125B, up a whopping 44% on the same time last year. AWS, (cloud services), had net sales of $12.7B with an operating income of $3.6B, more than half of the firm’s overall operating income.