NAB – 1Q21 Update

National Australia Bank is under Algo Engine sell conditions.

Revenue was down 3% and cash NPAT $1.65bn was ahead of market expectations given lower credit impairment charges.

National Australia Bank is under Algo Engine sell conditions.

Revenue was down 3% and cash NPAT $1.65bn was ahead of market expectations given lower credit impairment charges.

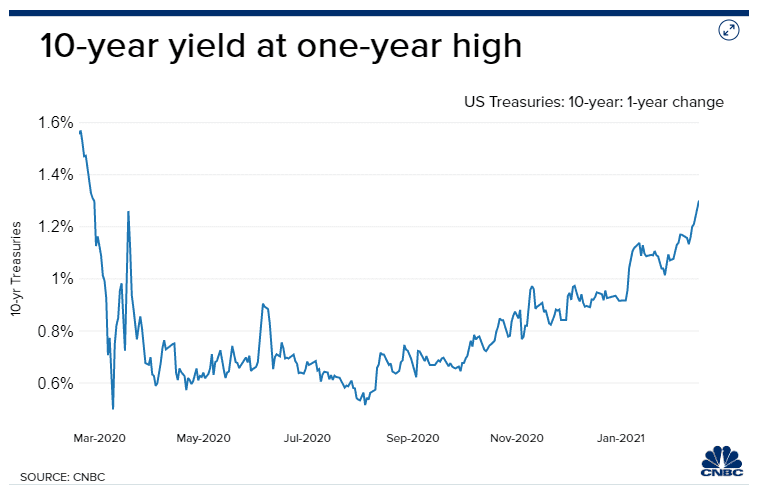

A rise in the yield of U.S. benchmark government debt has pushed it near thresholds that could fuel a wave of Treasury selling by mortgage investors, a scenario likely to exacerbate the bond selloff and cause rates to spike even further.

In Monday night’s webinar we’ll review the impact rising yields are having on asset allocation and stock selection models.

Coles Group is under Algo Engine buy conditions.

Coles delivered 1H21 EBIT growth of 7% or $1bn with a softer outlook and deceleration on the recent growth trends.

We remain buyers of Coles on share price weakness with support provided by the 3.6% yield.

Carsales.Com is under Algo Engine buy conditions and is a current holding in our ASX 100 model portfolio. The stock is up 14% since being added in December 2020.

1H21 result with adjusted EBITDA of $125 is up 16% on the same time last year. With the stock trading on 30+PE, the short-term upside is limited.

Forward yield into FY22 now stands at 2.6%, which is supported by 10%+ EPS growth.

Domino’s Pizza Enterprises is under Algo Engine buy conditions and is a current holding in our ASX 100 model portfolio. The stock is up 42% since being added back in November 2020.

Domino’s reported 1H21 sales up 17% and EBIT of $153 million, + 32%. Japan reported sales growth of 36%.

Brambles 1H21 underlying profit was ahead of consensus.

FY21 guidance was upgraded with revenue growth now expected

between 4-6% and underlying profit growth +5 to 7%.

We have BXB on a forward yield of 3.2%

Sonic Healthcare is looking oversold and we believe buying support will build within the $32.50 – $33.50 price range.

Xero is under Algo Engine buy conditions and is a current holding in our ASX 100 model.

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

ResMed is under Algo Engine buy conditions and we see buying support building.

Or start a free thirty day trial for our full service, which includes our ASX Research.