CSL – Accumulate

CSL is under Algo Engine buy conditions and is a current holding in our ASX 100 model portfolio.

Buy between the $240 – $265 price range.

CSL is under Algo Engine buy conditions and is a current holding in our ASX 100 model portfolio.

Buy between the $240 – $265 price range.

We watch the market demand with Bitcoin as one of a multitude of indicators that could translate into a peak in market PE expansion.

We’ll cover more on this in next Monday’s “Members Only” webinar.

Commonwealth Bank of is under Algo Engine sell conditions. We remain concerned about the declining profitability in retail banking.

Sell or short CBA on a break lower in the short-term momentum indicators.

The A2 Milk Company has now broken through the 10-day average and may be in the early statges of a recovery bounce.

Remain cautious and consider a stop loss should the price action reverse back below the average.

We watch the market demand with Bitcoin as one of a multitude of indicators that could translate into a peak in market PE expansion.

We’ll cover more on this in next Monday’s “Members Only” webinar.

The A2 Milk Company has now broken through the 10-day average and may be in the early statges of a recovery bounce.

Remain cautious and consider a stop loss should the price action reverse back below the average.

Bega Cheese is under Algo Engine buy conditions and is a current holding in our model portfolio.

The share price has rallied from the $5.00 support level, following the announcement of Bega’s move to take ownership of the Lion Dairy & Drinks business. This includes brands such as Dairy Farmers, Yoplait, Big M, Masters and Farmers Union Iced Coffee.

It’s a significant transaction for Bega as it presses ahead with plans to become an Australian-owned powerhouse in the food and drinks industry.

The combined group will have revenues of about $3 billion, with the addition of the Lion stable of brands more than doubling the size of Bega.

Silver Lake Resources is under Algo Engine sell conditions following the lower high at $2.00 in early January.

WA-based gold and copper miner Silver Lake Resources has maintained financial 2021 sales guidance between 240,000 to 250,000 ounces of gold, with copper sales guidance upgraded to 1600 tonnes from 1100 tonnes.

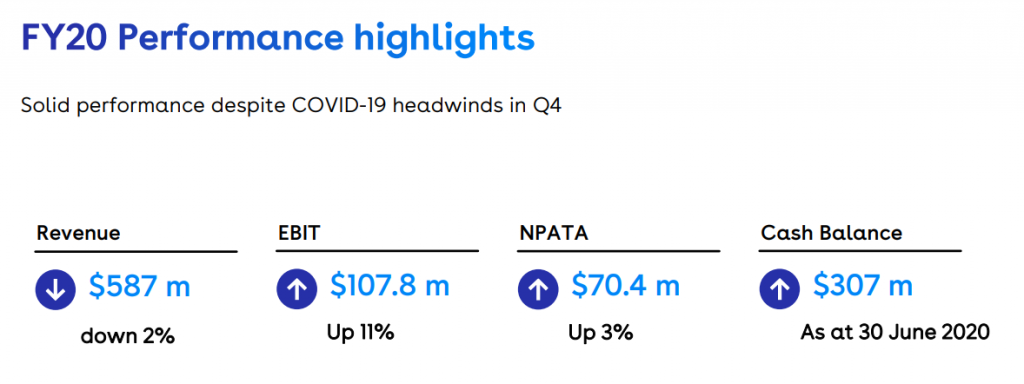

ASX:IDP is under Algo Engine buy conditions and is a new entrant to the ASX 100 index, following the December rebalance.

The snapshot below highlights the key earnings data from the FY20 period. We’ll review the upcoming numbers when the Dec period is announced.

The stock remains under review as we analyze the earnings outlook balanced against the high PE valuation the stock currently trades on.

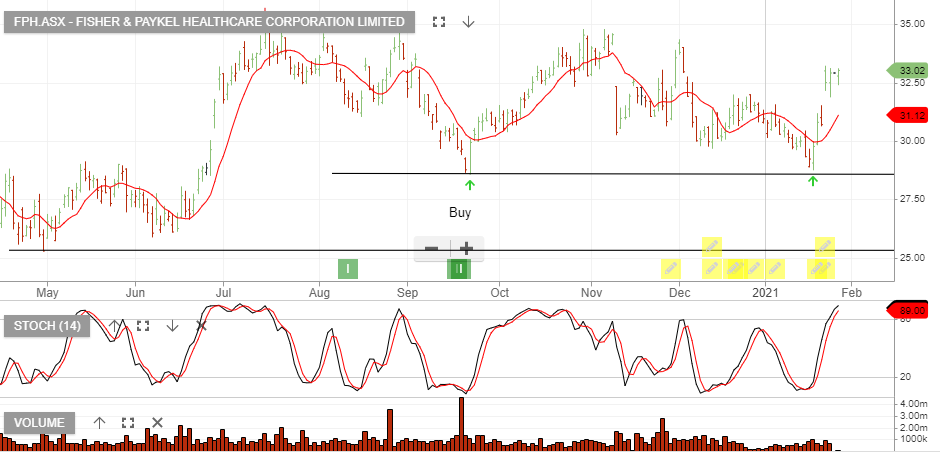

Fisher & Paykel Healthcare Corporation is under Algo Engine buy conditions and is a current holding in our ASX100 model portfolio.

The stock is expensive at almost 50x PE and investors should consider trading out of the recent rally should the short-term momentum indicators turn lower.

Resistance is likely to form within the $33.50 to $35 price range.

Or start a free thirty day trial for our full service, which includes our ASX Research.