WOW – Income Generation

We feel Woolworths provides further upside potential and adding a covered call option will enhance the income return.

For more detail on the derivative strategy, please call our office on 1300 614 002.

We feel Woolworths provides further upside potential and adding a covered call option will enhance the income return.

For more detail on the derivative strategy, please call our office on 1300 614 002.

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

We feel Woolworths provides further upside potential and adding a covered call option will enhance the income return.

For more detail on the derivative strategy, please call our office on 1300 614 002.

Coles Group looks to be creating another higher low formation at $17.80

As the valuation becomes slightly stretched, we suggest investors add a covered call option to enhance the income return.

For more detail, please contact our office on 1300 614 002

Altium is under Algo Engine buy conditions and is a current holding in our ASX model portfolio.

The momentum indicators have now turned positive and initial support looks to be in place at $34.75.

APA is under Algo Engine buy conditions and we see support building at the recent $10 higher low formation.

APA goes ex-div 23c on 30 December.

Bega Cheese is under Algo Engine buy conditions and is a current holding in our ASX model portfolio.

Bega Cheese is up 9% after announcing buying Lion Dairy & Drinks for $534 million. BGA is now trading at $5.42 compared to the $4.60 issue as part of its $284 million capital raising.

The chart below shows the range where we will be watching for the short-term momentum indicators to turn higher.

The price action now sits at 50% retracement of the March to November range. We expect to see buying interest begin to rebuild.

Ansell is under Algo Engine buy conditions and we see support building within the $33 – $36 level.

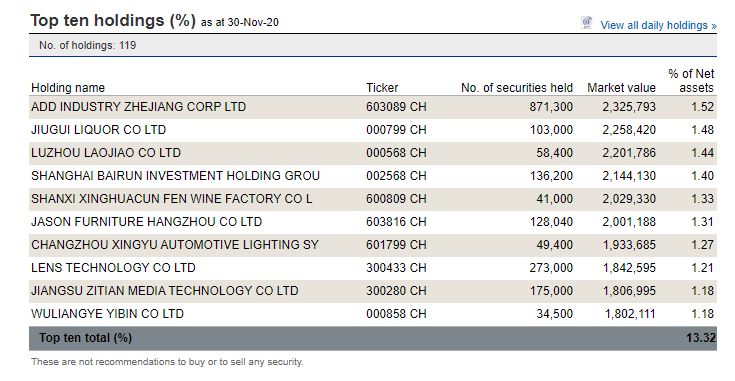

CNEW gives investors a portfolio of the most fundamentally sound companies in China having the best growth prospects in sectors making up ‘the New Economy’, namely technology, health care, consumer staples and consumer discretionary.

{AXW:CNEW) is now under Algo Engine buy conditions and we add this to our long-term model portfolio.

Or start a free thirty day trial for our full service, which includes our ASX Research.