Ausnet – Algo Buy

AusNet Services is under Algo Engine buy conditions.

AusNet Services is under Algo Engine buy conditions.

The chart below shows the range where we will be watching for the short-term momentum indicators to turn higher.

The price action now sits at 50% retracement of the March to November range. We expect to see buying interest begin to rebuild.

Ansell is under Algo Engine buy conditions and we see support building within the $33 – $36 level.

Carsales.Com is under Algo Engine buy conditions and is now a new holding in our ASX 100 model portfolio.

Clean Teq Holdings is now under Algo Engine buy conditions with price support at $0.25

The name is outside our usual spectrum of stocks but I’ll be taking a closer look at the fundamentals and will review this further in Monday’s blog and webinar.

Ansell is under Algo Engine buy conditions and we see support building within the $33 – $36 level.

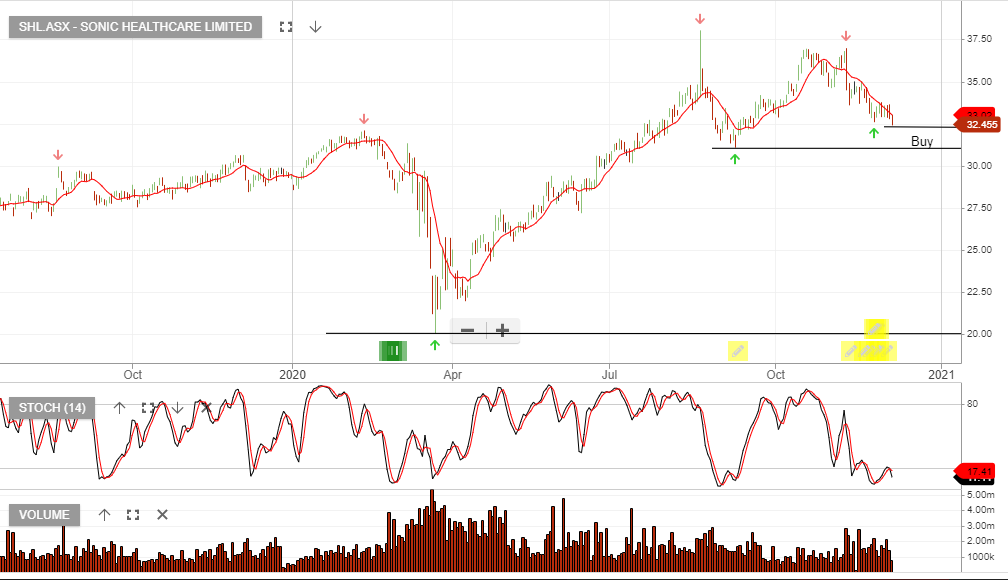

Sonic Healthcare is finding buying support and we’re likely to see an improvement in the short-term indicators as the stock price stabilizes near the $32.50 level.

Fisher & Paykel Healthcare Corporation is under Algo Engine buy conditions and is now consolidating above the $30 support level.

Investors should consider a buy-write strategy to enhance the income return. For more detail please call our office on 1300 614 002.

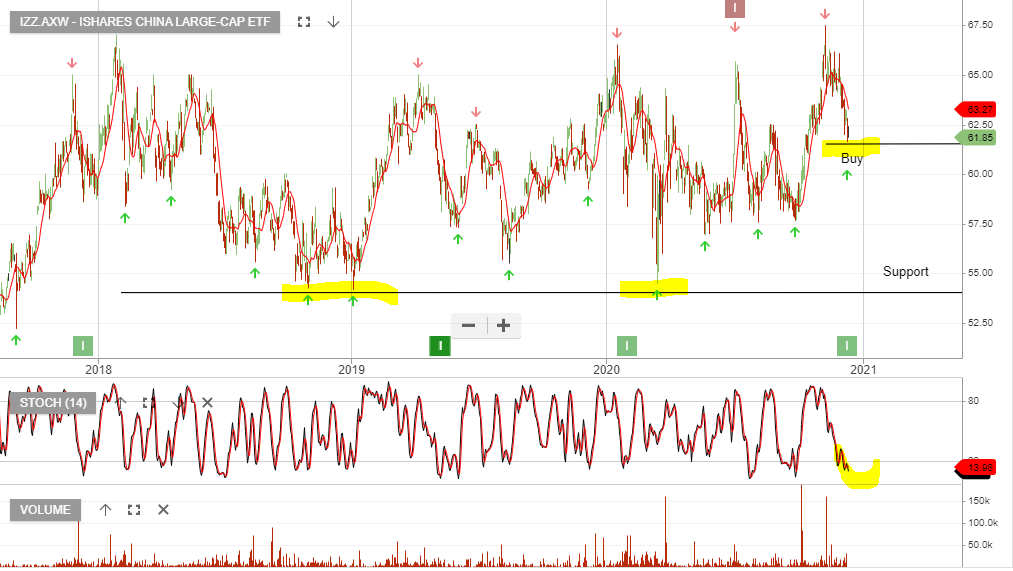

China GDP is forecast to increase to 8% next year, supported by a recovery in local demand and a better global environment as a coronavirus vaccine is deployed.

China’s long-term growth potential of around 5.5% is considered a baseline level of growth. However, 2020 will be below at approximately 2.3%.

Analysts predict global growth to contract 3.7% in 2020, yet expand 5.3% next year.

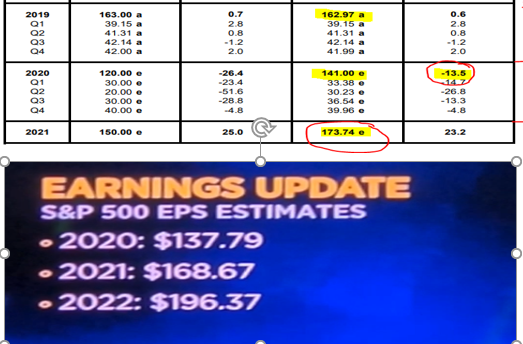

Whilst we’re attracted to the growth prospects in China, we remain cautious on the level of forward earnings growth “baked” into the current US equity market forecasts for 2022.

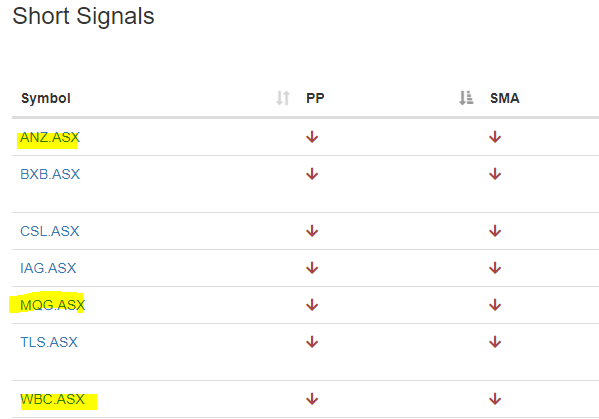

Using the features of the new “Trade Table” tab in our member area we can see the 3 bank stocks which now exhibit what may be faltering momentum.

The highlighted names are all under Algo sell signals, with a negative pivot point arrow and the current share price has broken below the 10-day average.

For more detail on how this software feature works, please call our office on 1300 614 002.

Or start a free thirty day trial for our full service, which includes our ASX Research.