Amcor – Buy

Amcor is under Algo Engine buy conditions and is a current holding in our ASX 100 model portfolio.

Buy AMC at $14.70

Amcor is under Algo Engine buy conditions and is a current holding in our ASX 100 model portfolio.

Buy AMC at $14.70

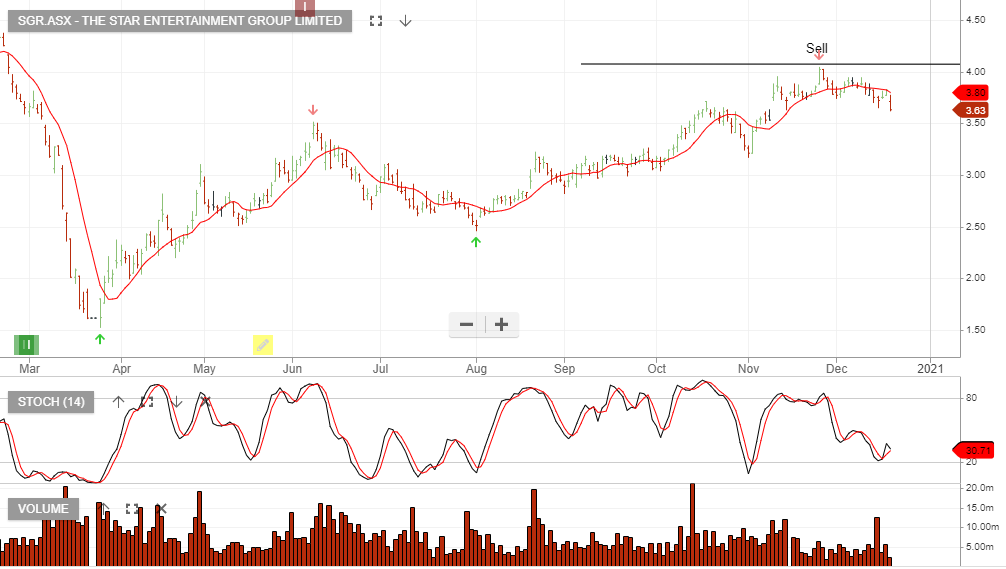

The Star Entertainment Group is under Algo Engine sell conditions and the “trade table” highlights the alignment of the down pivot point and the current trading price below the 10 day average.

For further detail on how the “trade table” feature works, please call our office on 1300 614 002.

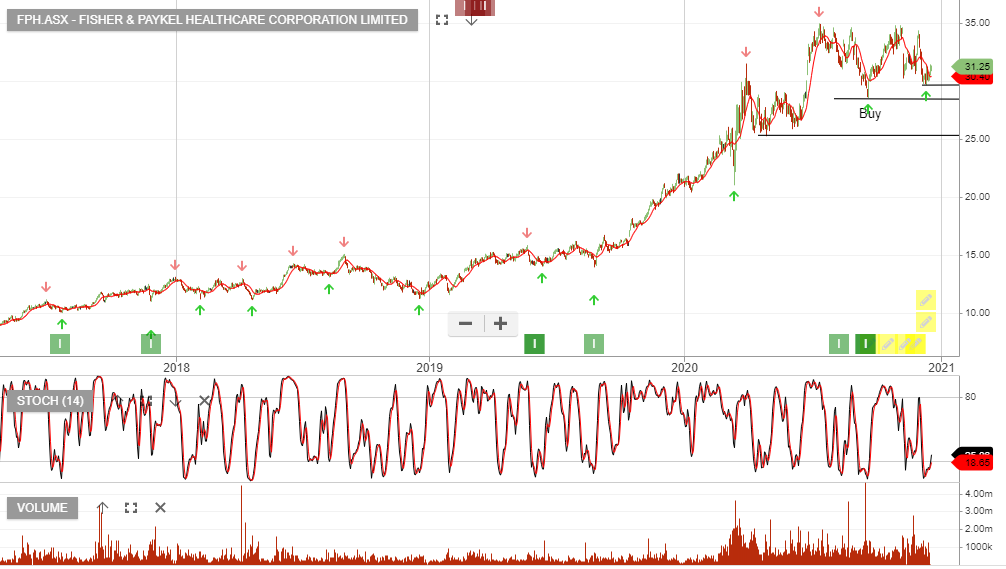

Fisher & Paykel Healthcare Corporation is under Algo Engine buy conditions and is now consolidating above the $30 support level.

Investors should consider a buy-write strategy to enhance the income return. For more detail please call our office on 1300 614 002.

Cochlear is now under Algo Engine buy conditions and has been added to our ASX 100 model portfolio.

We expect 10% EPS growth over the next 12 months. Although, the stock remains expensive at 40x earnings and trading on a 1.8% yield.

Ansell is under Algo Engine buy conditions and we see support building within the $33 – $36 level.

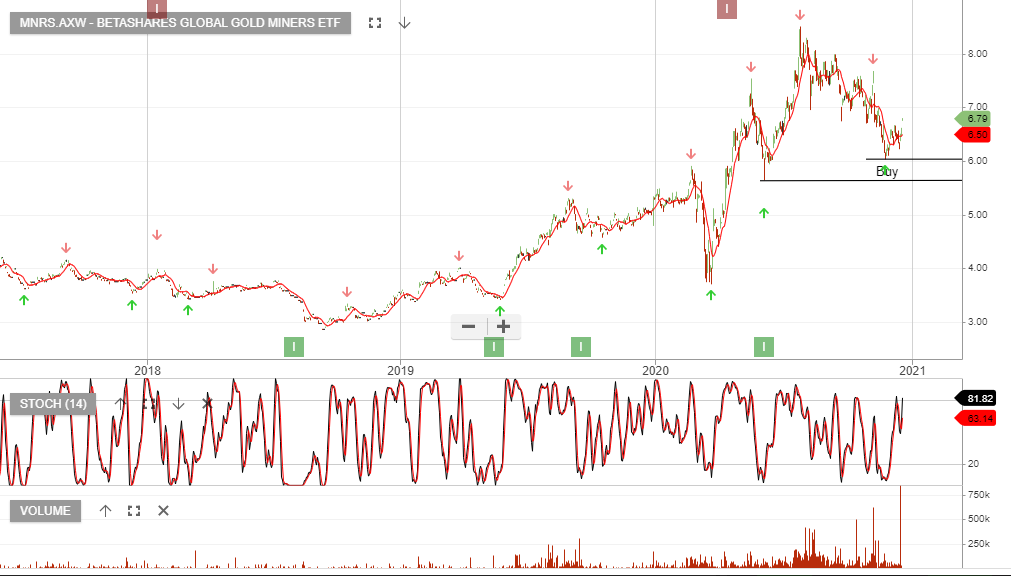

Super Pit joint owners Northern Star and Saracen Mineral Holdings are set to combine, having agreed to a merger-of-equals worth $16 billion.

The proposed merger will create a new top 10 global gold major with a world-class portfolio and three large-scale production centres in Kalgoorlie and Yandal in Western Australia, as well as in North America.

Northern Star Resources Algo buy signal

{ASX:SAR) Algo buy signal

BetaShares Global Gold Miners is under Algo Engine buy conditions.

MNRS aims to track the performance of an index, (before fees and expenses), that comprises the largest global gold mining companies (ex-Australia), hedged into Australian dollars.

As Gold rallies from the recent US$1770 level to US$1890, we expect to see renewed buying interest in the related ETFs and the listed gold miners.

Vaneck Vectors Gold Miners is under Algo Engine buy conditions.

GDX provides broad exposure to the leading global gold producers. After the recent sell-off from $65 down to $45, we’re now seeing buying interest rebuild and the short-term momentum indicators have turned higher.

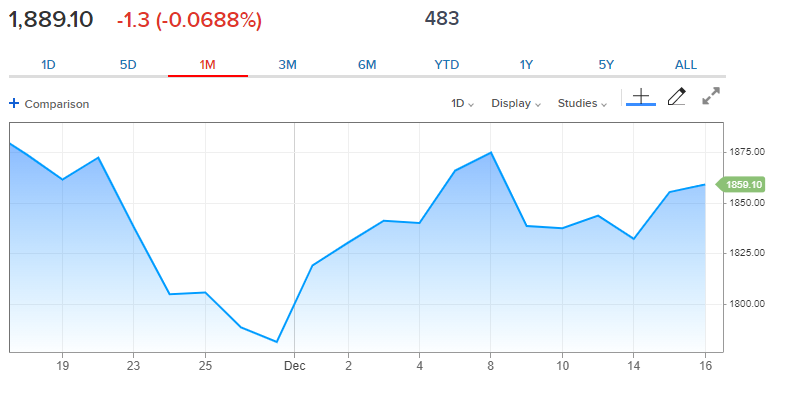

S&P/ASX is under Algo Engine buy conditions since forming a higher low on 21 September this year.

As PE valuations expand and evidence of earnings growth remains minimal, we see risks increasing for the overall market, both domestic and international equities.

With the above in mind, it’s prudent to tighten the stop loss or market reversal level and the chart below highlights 6630 as support.

CWY was recently added to our ASX Top 100 model portfolio following the shift to Algo Engine buy conditions at $2.05.

The recent pullback from the $2.60 high provides another opportunity for investors to add CWY to their portfolios.

We see price support at $2.30 and suggest watching the short-term indicators for a turn higher, near, or just above this support.

Call our office on 1300 614 002 if you would like more detail on our current portfolio holdings.

Or start a free thirty day trial for our full service, which includes our ASX Research.