Macquarie Group – 1H21

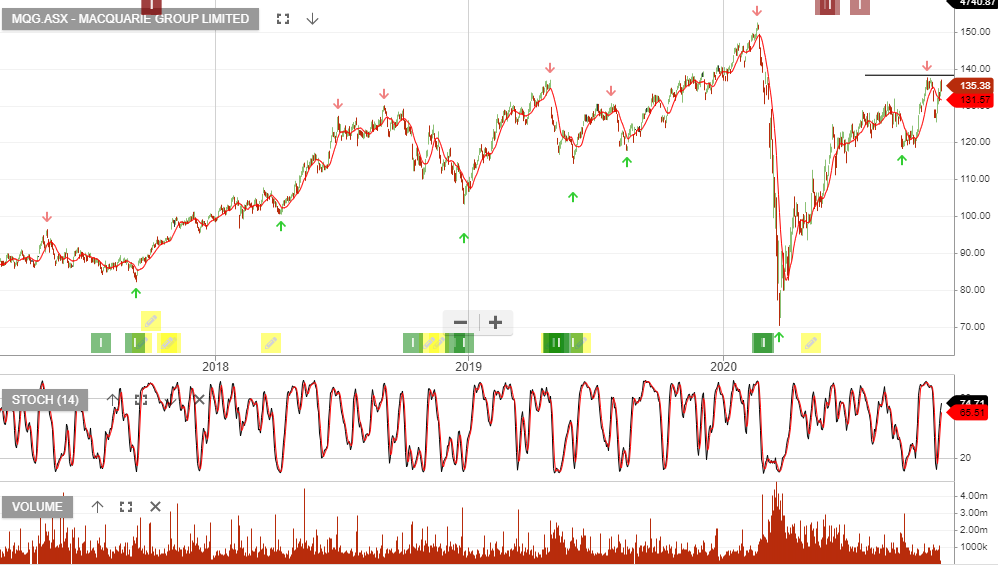

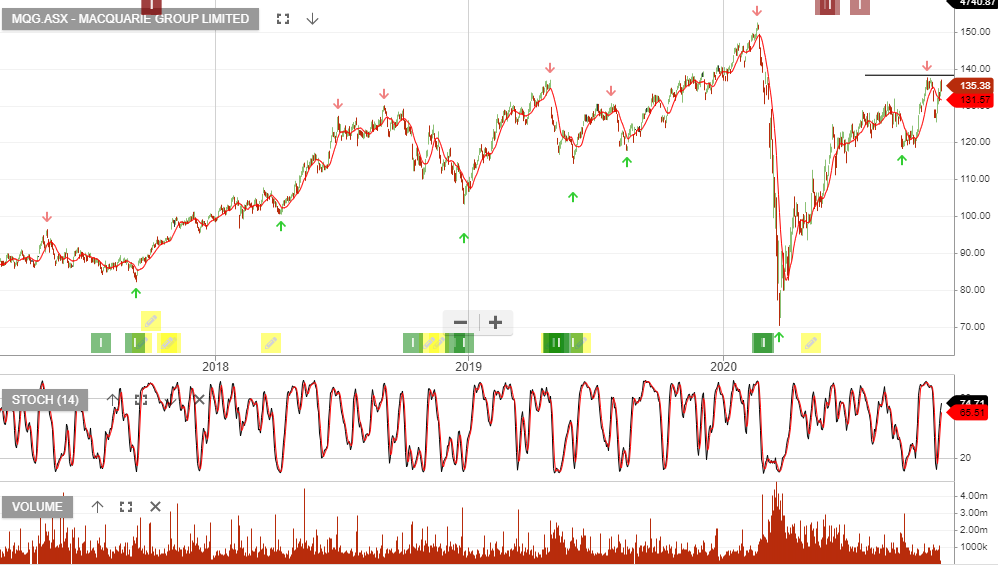

Macquarie Group is under Algo Engine sell conditions and has overhead price resistance at the $135 level.

MQG reported 1H21 net profit of $985mn down 23% on the same time last year.

Macquarie Group is under Algo Engine sell conditions and has overhead price resistance at the $135 level.

MQG reported 1H21 net profit of $985mn down 23% on the same time last year.

Woolworths Group has been trading sideways in 2020 within the $35 to $40 price range. This provides a trading range for investors to consider or alternatively, selling calls at the upper band to generate extra cash flow.

On a valuation basis, using 10% EPS growth into 2022, it supports a 3% fully franked dividend yield and places the stock on a 34x forward PE ratio.

Deterra Royalties is the new ASX listed company which separated from Iluka Resources. DRR owns Iron Ore royalties as the primary business.

The company is likely to see strong revenue growth over the coming years, generated by increased production from the current assets and new assets through either acquisition or financing development projects.

Based on FY22 earnings we have DRR trading on a forward yield of 5%+

Newcrest Mining remains under Algo Engine buy conditions. NCM has reported an in-line 1QFY21 result with group production of 503koz.

The company expects an improved production performance in 2Q.

We suggest investors accumulate NCM above the $29 support level.

Since writing the above post NCM has bounced off the $29 support level and is now trading at $30.64. The momentum indicators continue to trend higher.

iShares Global Healthcare is under Algo Engine buy conditions and we see price support building near the current $96.50 level.

IXJ has rallied from the $96 support level and we see continued long term growth for the ETF.

APA is under Algo Engine buy conditions and we see support building at the recent $10.50 higher low formation.

APA has now rallied to $11.13 and goes ex-div 23c on 30 December.

After recently taking profit in the CURE ETF, we again add the name back onto our watchlist and identify the range where we expect buying support to rebuild.

Buy $58.50 target.

Separate to the above opportunity, we see upside in the large-cap biotech stocks in the US. In particular, we like Abbvie, Biogen, Gilead, Johnson & Johnson, Merk, and Pfizer.

If you’d like to discuss setting up a US broking account with Investor Signals, please call me on 1300 614 002.

Since writing the above post CURE has rallied 5% and the large-cap biotech names were among the best performers overnight in the US.

Biogen rallied 44% overnight. This is a holding in our US high conviction portfolio.

Buy TPG Telecom above the $7.00 support level.

Brambles is under Algo Engine buy conditions and is a current holding in our ASX model portfolio.

Brambles provided a trading update for the 1Q FY21 revenues, which were up 5% on the same time last year.

Underlying profit on a constant currency basis is expected to be around +3% to +5%. This supports the FY21 yield of 2.9% and FY22 3.3%.

Commentary from the TLS chairman today suggests a strong desire to maintain a 16cps dividend, through to 2023.

Or start a free thirty day trial for our full service, which includes our ASX Research.