Brambles – Buy

Buy Brambles within the $10.50 – $10.75 price range.

Buy Brambles within the $10.50 – $10.75 price range.

Newcrest Mining remains under Algo Engine buy conditions and we recommend investors accumulate between $30 – $32.

APA is likely to find increased buying support at $10 and trade higher.

Since making the above post on 23 Sept, APA has rallied 8% and the short-term indicators have turned positive.

We continue to see APA as a low-risk opportunity even if the market sentiment was to shift more negative.

Register here, so that we can email you the link to tonight’s webinar, fifteen minutes before it begins.

Start Time: 8pm NSW time.

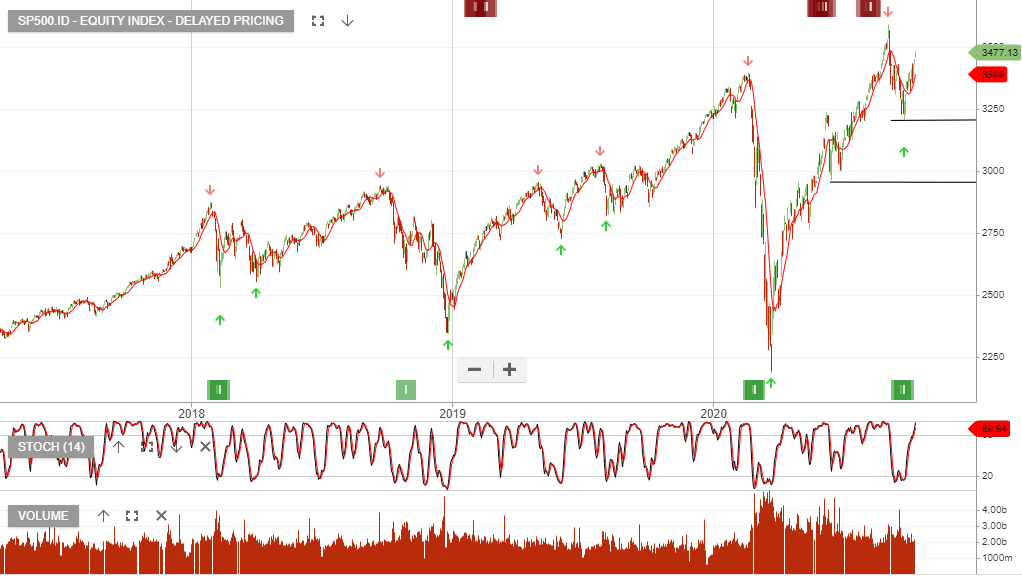

Q3 earnings season starts this week with Citigroup reporting tomorrow. Profit for S&P 500 companies is forecast to be down 20%, which will be an improvement on the -30% Q3 numbers.

13 Oct BlackRock, Citigroup, JPMorgan, Delta Air Lines, Johnson & Johnson;

14 Oct Bank of America, Goldman Sachs, U.S. Bancorp, UnitedHealth, United Airlines and Wells Fargo;

15 Oct Charles Schwab, Morgan Stanley and Walgreens; and

16 Oct Bank of New York and J.B Hunt.

Last week delivered a 100% gain for Rolls-Royce, though it remains down 66% on the year. The aviation sector has been hard hit from the COVID-19 pandemic, but there might be light at the end of the tunnel.

We have a US listed company that we think can follow a similar path and may double in value.

Register for tonight’s webinar and we’ll share the company name with you and outline our analysis.

Buy TPG Telecom

Qube Holdings is under Algo Engine buy conditions and has now been added to our ASX model portfolio.

FY21 revenue is forecast to increase 3% to $1.95bn and EBITDA flat at $300m. Qube may start to deliver 8 – 10% EPS growth into FY22 and FY23, which will support the forward yield of 2%.

We see price support developing within the $2.25 to $2.50 range.

Since writing the above post on 2 October, Qube has seen a pickup in buying interest and the short-term indicators are trending higher.

Vaneck Vectors Gold Miners is under Algo Engine buy conditions.

GDX provides broad exposure to the leading global gold producers.

Newcrest Mining remains under Algo Engine buy conditions and we recommend investors accumulate between $30 – $32.

Or start a free thirty day trial for our full service, which includes our ASX Research.