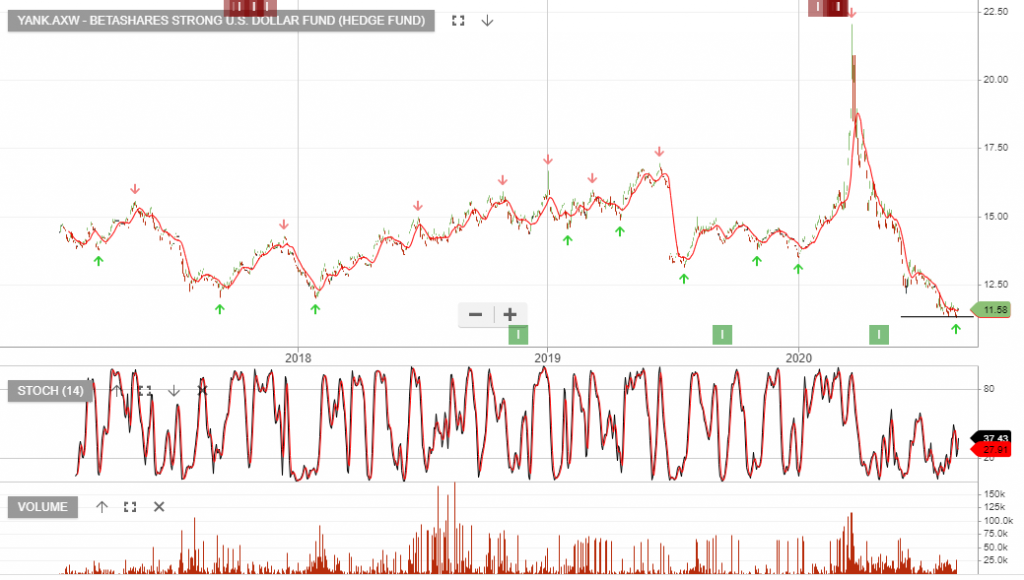

YANK

Betashares Strong U.S. Dollar Fund (Hedge

The US dollar has been trading lower over recent weeks and should we see a pick up in market volatility and risk-off sentiment builds, the US dollar may find increased buying support.

YANK looks to be finding support at $11.25

Since writing the above post back in August, YANK has traded higher and we continue to see support near the $11.25 range.