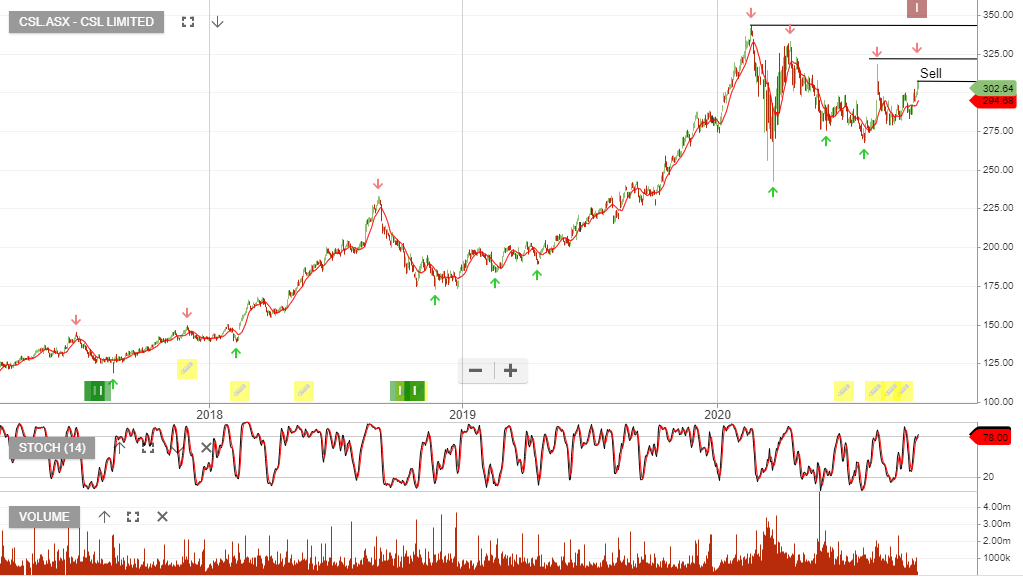

CSL has now shifted to sell conditions after being in our model portfolios since May 2015. With dividends, the stock has increased by 250%.

CSL has raised its full year profit guidance to between 3% – 8%, despite warnings of higher plasma costs. The lower end of guidance had previously been zero.

Full-year FY21 is now expected to be between $2.2bn and $2.26bn. We continue to see reliable earnings growth for CSL, however, the 40x multiple may prove to be too rich in the short-term.