Register for Monday’s Webinar

Our webinar on Monday will start at 7pm NSW time.

Register now and we’ll send you the webinar link on Monday evening.

Our webinar on Monday will start at 7pm NSW time.

Register now and we’ll send you the webinar link on Monday evening.

Orica is under Algo Engine buy conditions and is a current holding in our ASX 100 model portfolio.

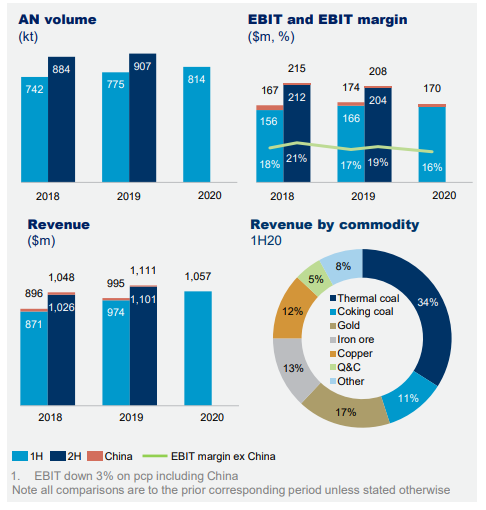

FY21 revenue is likely to remain flat at $5.8bn and EBIT is forecast to increase 3-5% to $630mn. This supports a forward yield of 2.8%.

Earnings are likely to be well supported due to higher volumes and the strength in the mining industry, especially from the gold mining market.

Earnings may surprise to the upside and we continue to hold ORI into the next earnings release.

Gold Road Resources has now switched to Algo Engine buy conditions. The correction from $2.00 down to Friday’s price level of $1.55 presents a low-risk entry opportunity.

The short-term indicators have now turned higher.

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

Nextdc FY20 revenue $200m, EBITDA $104m and EPS negative $0.12. Nil dividend.

Excluding depreciation and amortization add-backs, NXT operates at a loss. We continue to monitor the recent claim made by a fund manager, regarding the questionable accounting standards adopted by the company.

NXT is now guiding to FY21 revenue to be in the range of $240m – $250m.

Orica has found support after re-testing the $17 higher low price point.

Sonic Healthcare FY21 revenue +5% to $7.4bn and EBIT growth of 5%+ supports a forward yield of 3%.

FY21 EBITDA estimates, range from $1.5bn – $1.75bn.

Buy Sonic within the $30 – $32 price range, as indicated below.

Coles Group is now under Algo Engine buy conditions following the sell-off from $19.30 down to $17.50.

We expect Coles share price to track sideways within the $17 – $19 price range and suggest investors consider overlaying a covered call option to enhance the cash flow return.

For more information on the strategy, please call our office on 1300 614 002.

Or start a free thirty day trial for our full service, which includes our ASX Research.