TPG – Buy

Buy TPG Telecom

Buy TPG Telecom

U.S. consumer spending appeared to slow in August as extended unemployment benefits were cut for millions of Americans.

Job growth slowed further and new applications for unemployment benefits remained at high levels in September.

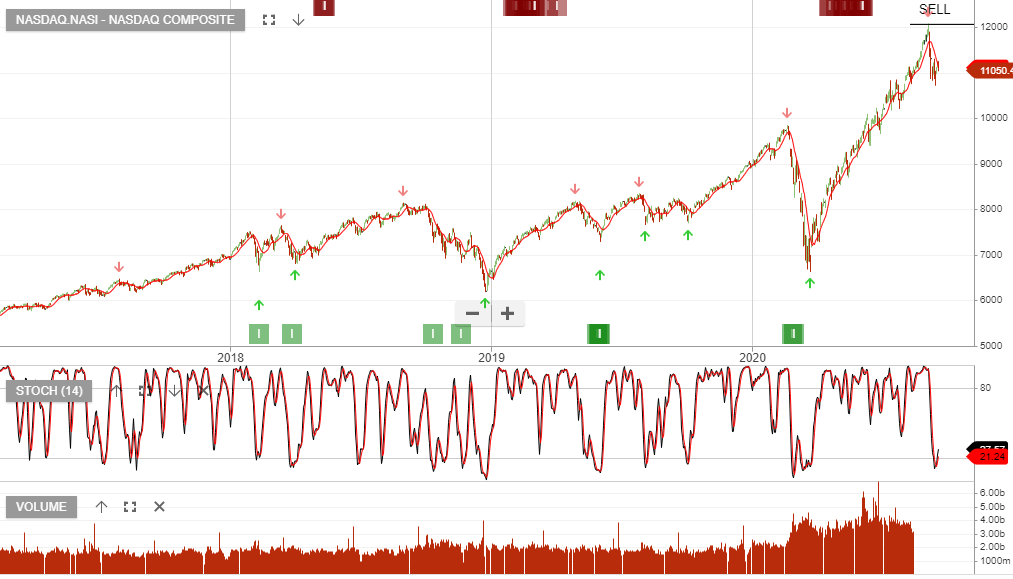

The correction in the NASDAQ continues, as reflected in the daily close levels below the 10-day average.

For more detail on our portfolio hedging strategies, please call 1300 614 002.

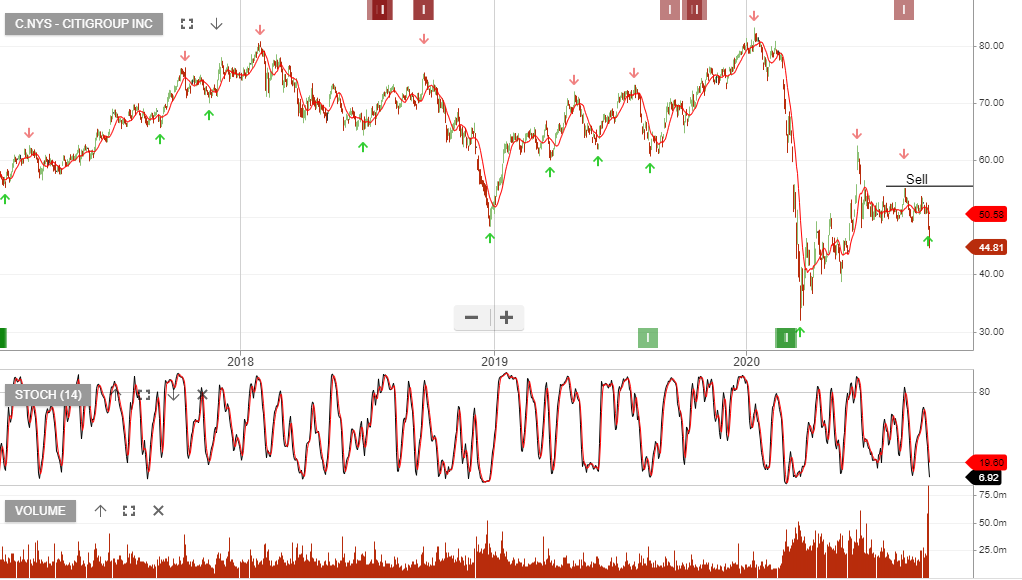

Citigroup was more downbeat about recent economic trends than some peers. The bank’s latest forecast contemplates a slower pace of economic recovery, particularly in the U.S.

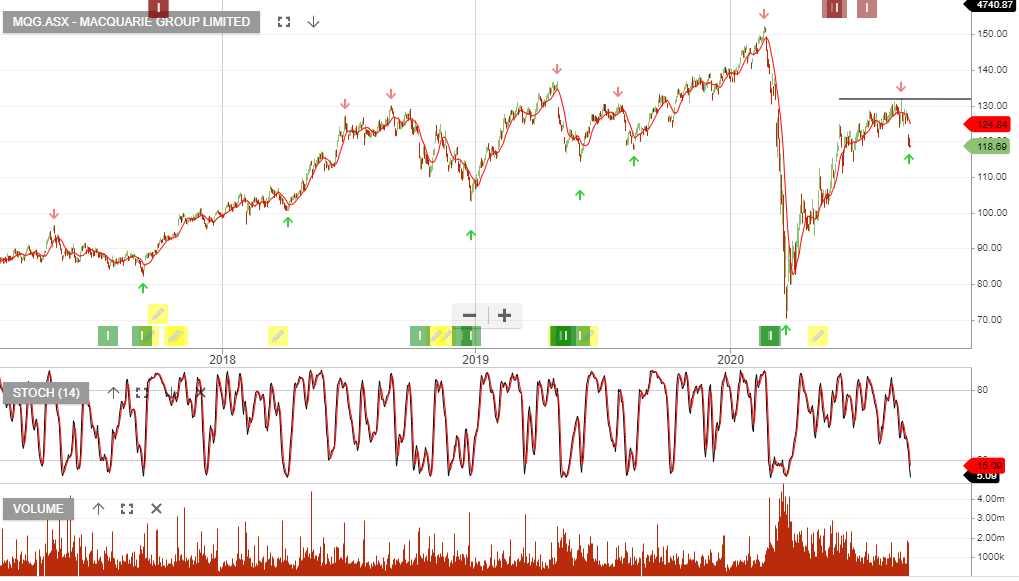

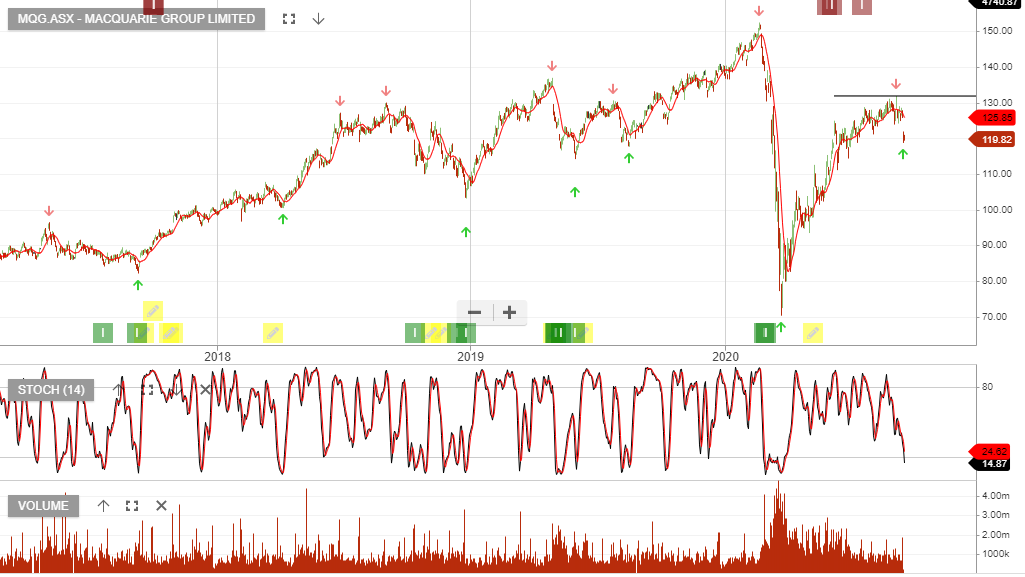

Macquarie Bank has guided to 20 – 30% lower earnings in FY21.

ETFS S&P Biotech rallied 10% from last week’s $52 low.

If you missed last night’s webinar, then you can catch up by watching it here.

For regular listeners to our weekly webinar series, you’d be aware of our negative outlook on Macquarie Bank and the overhead resistance at $130 per share.

1H21 profit guidance is now 35% lower than the same time last year, this implies 1H21 profit of $950mn.

There may be room for a slight improvement in the 2H21, due to asset sales but the outlook for full year earnings remain well below FY20 levels.

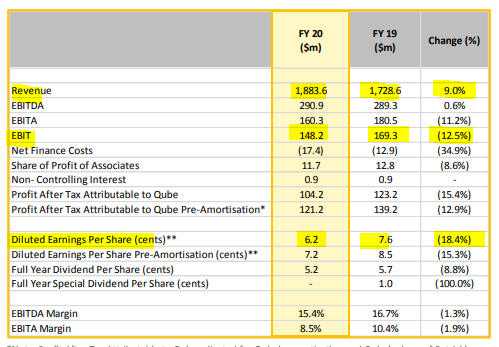

Qube Holdings is now under Algo Engine buy conditions and as part of the review, we take a closer look at the FY20 earnings results.

COVID has had a negative impact on overall volumes and we expect to see a gradual improvement over FY21 and FY22.

About

Qube is Australia’s largest integrated provider of import and export logistics services with a market capitalisation in excess of $4.88 billion as at 30 June 2019.

We operate in over 130 locations across Australia, New Zealand and South East Asia with a workforce of over 6,500 employees.

Qube is comprised of three business units including Ports, Bulk and Logistics division, Infrastructure and Property division and Strategic Assets division. We also hold a 50 percent interest in Patrick Terminals, Australia’s leading container terminal operator.

FY20 Earnings

Buy Pro Medicus

Tonight’s webinar begins at 7pm. Please register and we’ll send you the webinar link, just before the start time.

Or start a free thirty day trial for our full service, which includes our ASX Research.