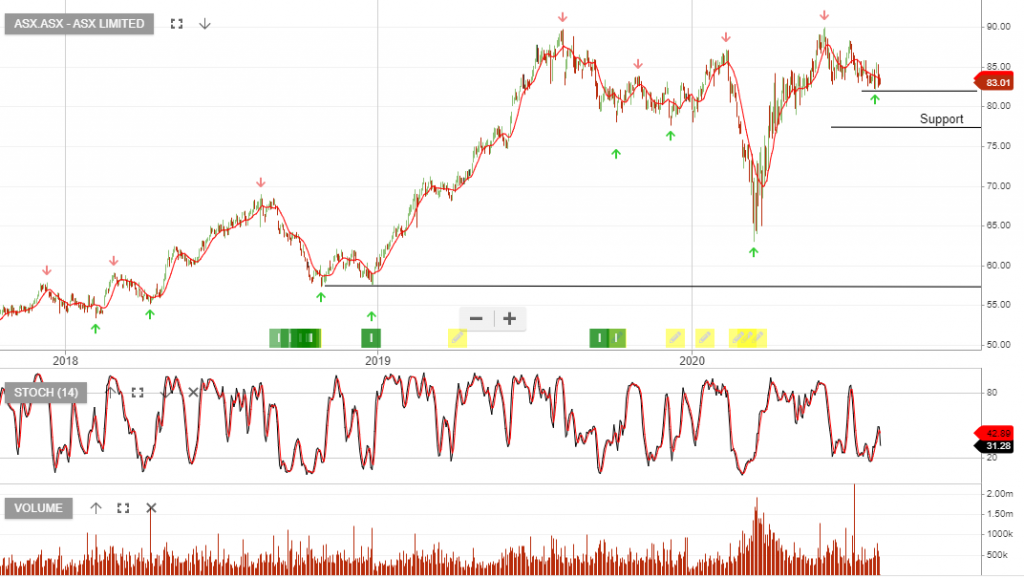

ASX – Trading Volumes

ASX is under Algo Engine buy conditions and is a current holding in our ASX 100 model portfolio.

July trading volumes show cash market: 32.5m, (lower than the 12-month average of 38.4m) and total value traded in July rose to $140.5bn, (July 2019’s $126.8bn).

Derivatives total of 8.6m contracts, down 22% on a year ago and much lower than the past 12-month average.

Volumes are expected to remain below the elevated levels of the past few months.

ASX is a quality business and we look to add to the position at lower price levels.