JB Hi-Fi – FY20 Earnings

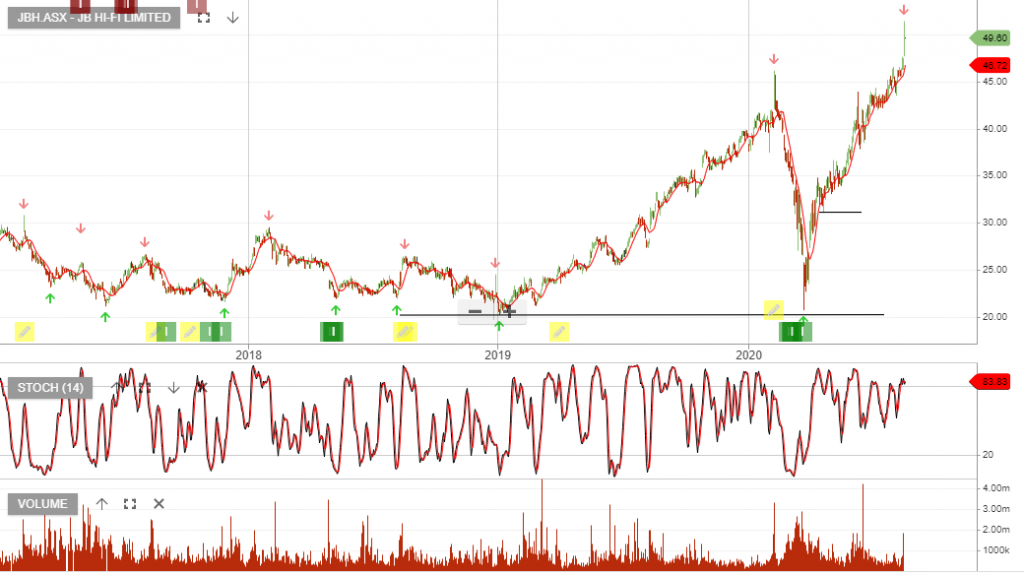

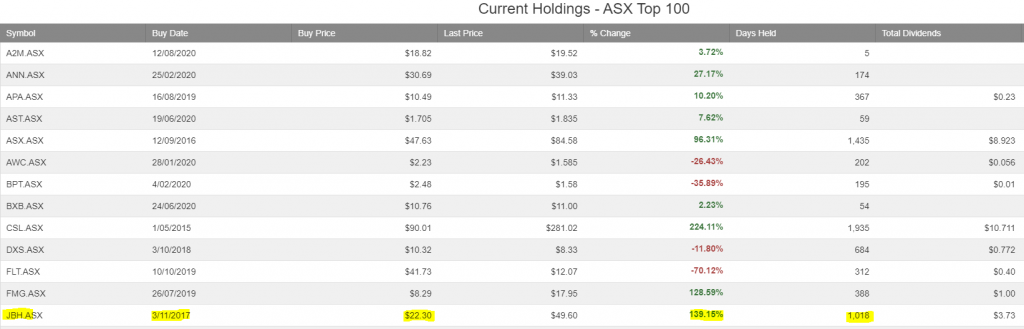

JB Hi-Fi is among the best-performing stocks within our ASX 100 model portfolio. The stock was added back on the 3rd of November 2017 after switching to Algo Engine buy conditions.

JB Hi-Fi delivered FY20 underlying NPAT of $332mn above the top end of the guidance range of $325 to $330 million.

The 2H20 dividend of $0.90 was above consensus. Overall, the result was ahead of expectations, however, near-term risks to discretionary spending are high.