Pro Medicus

The company continued its growth trajectory in FY20 with revenue from underlying operations up 24% and underlying profit before tax up 33%.

The company continued its growth trajectory in FY20 with revenue from underlying operations up 24% and underlying profit before tax up 33%.

Brambles remains under Algo Engine buy conditions.

FY20 earnings were in-line with market consensus with EBIT flat on the same time last year. On a constant currency basis, EBIT increased 4%, which was in-line with management guidance for 3 – 5% growth.

BXB generates a large percentage of its revenue from consumer

staples and grocery supply chains, making it a relatively safe harbor for investors. At 22X forward earnings and a 2.2% yield, there’s not much upside in the share price on a 12-month outlook.

We suggest investors add a covered call option to enhance the income return.

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

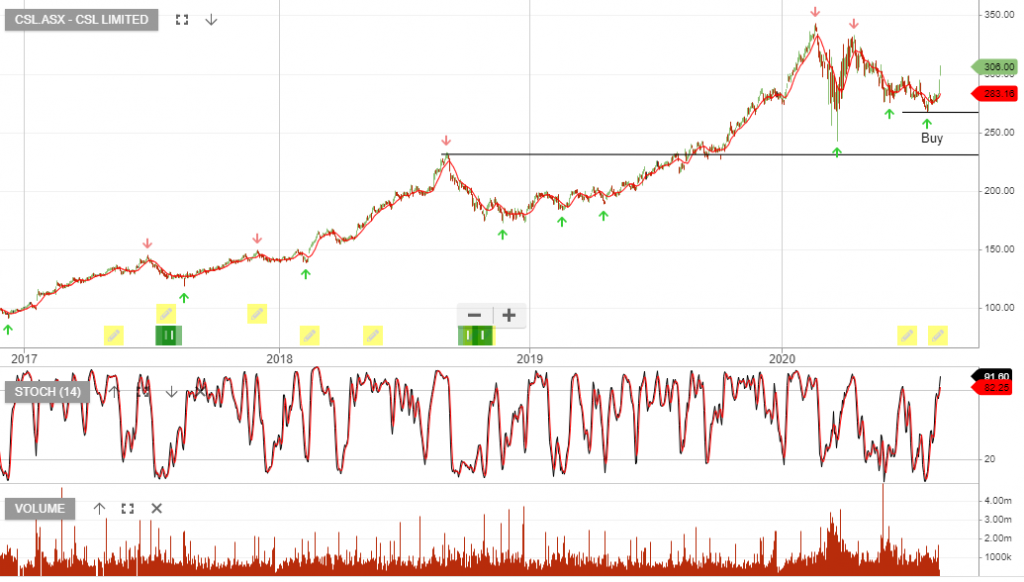

We’ve been highlighting the buy-side opportunity in CSL from the $270 support level. The share price has since rallied 15% and traders can now consider locking-in the gains.

Investors may wish to stick with the longer-term momentum and reassess following the FY20 earnings release today.

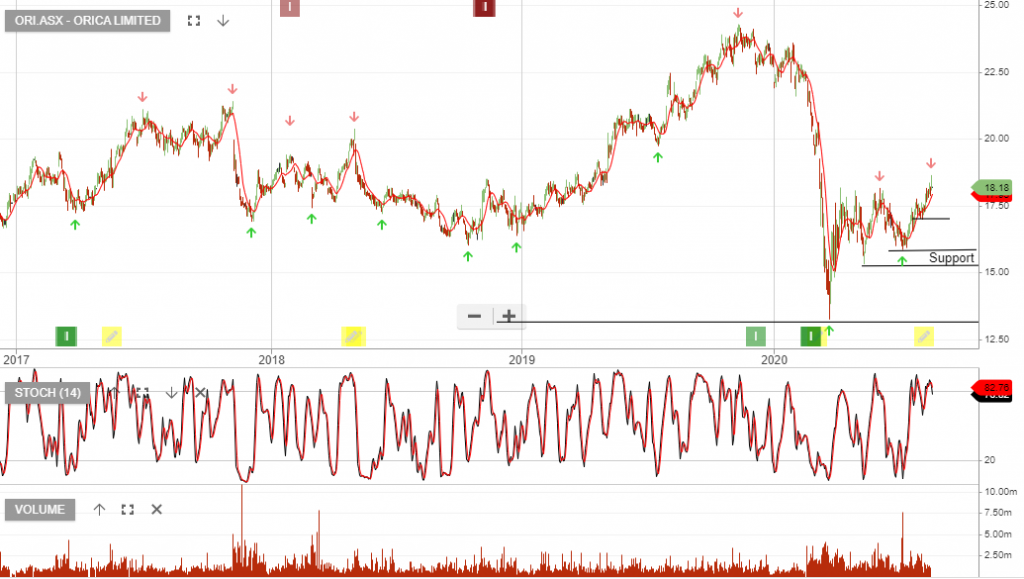

After accumulating Orica on the $16.50 higher low formation, we now see the share price trading within our $18 – $19 price target.

With the trade offering over 10% return, locking in the gains is the “no-lose” scenario.

Investors will be waiting until Q4 for the 6 months to September earnings update. The last reported results for the six months to 31 March 2020, showed statutory Net Profit After Tax (NPAT) of $165 million compared to $33 million in the prior corresponding period. Earnings Before Interest and Taxes (EBIT) were up 2%.

Note: 25 JUNE 2020 ORICA COMPLETES SUCCESSFUL LONG-TERM US PRIVATE PLACEMENT.

Orica completed a new US$451 million and A$70 million (A$725 million equivalent) issue of fixed-rate senior unsecured notes (“Notes”) in the US Private Placement (USPP) market. Initially launched as a US$250 million issue to refinance a USPP maturing in October 2020, the transaction achieved a final order book of US$1.3 billion representing an oversubscription of more than 5x.

Investors may choose to focus on the strong balance sheet and strength within the mining industry as reasons to stick with the longer-term thematic underpinning Orica.

Following the recent Algo Engine buy signal we’ve added exposure to Pro Medicus. The company will report its full-year result Thursday 20 August.

Traders can consider locking-in the 10%+ gains following the rally in Bega Cheese.

Investors may wish to review the FY20 earnings, to be announced on 27 August.

We’ve been buyers of Brambles on the recent sell-off and the stock has since rallied 7%.

In a low growth environment we see BXB running into short-term resistance near the $11.50 price range.

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

If you missed our webinar last night, then catch up by watching it here.

Or start a free thirty day trial for our full service, which includes our ASX Research.