Technology One +9%

Technology One rallied 9% following the recent Algo Engine buy signal. The short-term indicators supported the reversal from the $8.00 higher low formation.

Stay long TNE with stops below $8.00.

Technology One rallied 9% following the recent Algo Engine buy signal. The short-term indicators supported the reversal from the $8.00 higher low formation.

Stay long TNE with stops below $8.00.

TPG Telecom rallied from its $7.07 low and the short-term indicators have now turned positive.

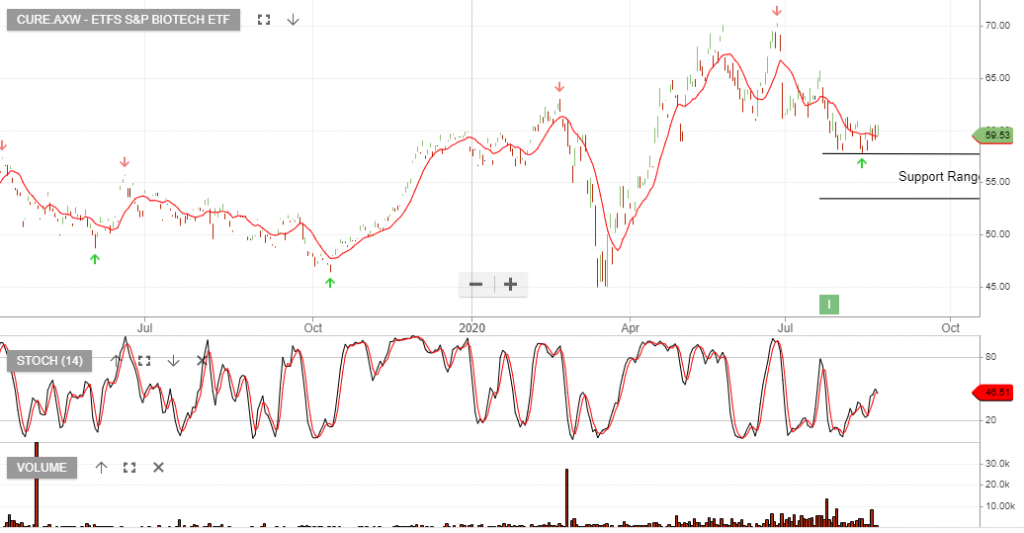

ETFS S&P Biotech is under Algo Engine buy conditions. Buying support has been building since the price traded at $58.

CURE ETF offers investors exposure to US biotechnology companies.

Pro Medicus delivered another record result, with strong growth supported by new contract wins.

We continue to see this as an attractive growth opportunity.

{A2M} is now under Algo Engine buy conditions and we see buying support at $18.50.

TPG Telecom has traded down to $7.07 and we see an opportunity approaching where the stock price is likely to reach oversold levels.

Keep an eye on the short-term momentum indicators, especially if we see a probe below $7.00.

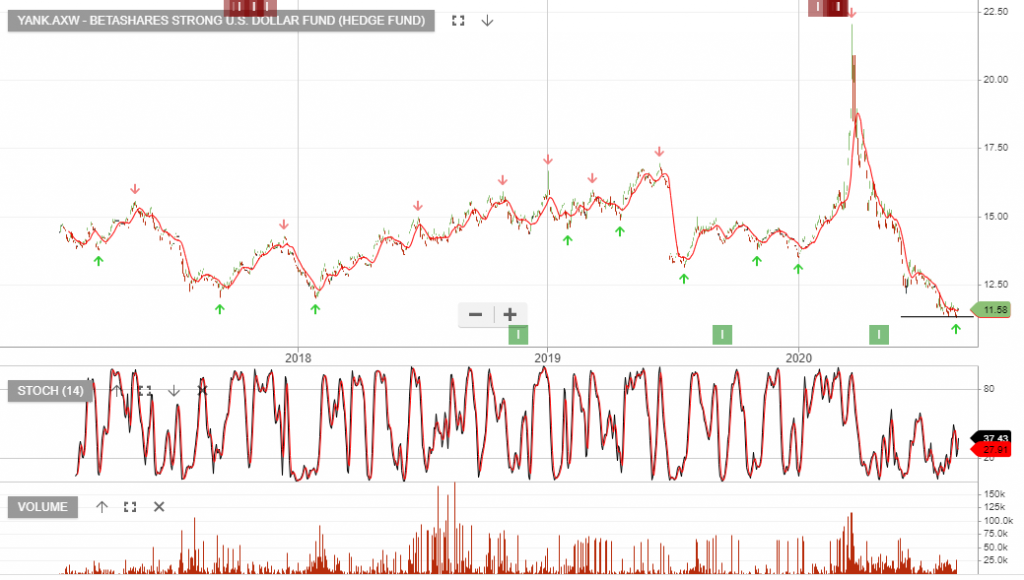

Betashares Strong U.S. Dollar Fund (Hedge

The US dollar has been trading lower over recent weeks and should we see a pick up in market volatility and risk-off sentiment builds, the US dollar may find increased buying support.

YANK looks to be finding support at $11.25

Newcrest Mining remains under Algo Engine buy conditions and we recommend investors accumulate between $32 – $34.

Beach Energy is the only top 100 energy stock under algo engine buy conditions. Buying interest is building above the $1.40 support level.

FY20 underlying NPAT of A$500mn was ahead of market expectations.

The A2 Milk Company is now under Algo Engine buy conditions and has recently been added to our ASX 100 model portfolio.

A2M reported 2HFY20 earnings showing strong EPS growth underpinned by higher infant formula volumes.

The result fell slightly short of high expectations, although revenue growth remained strong, increasing by 30% on the same time last year and FY20 EBIT jumped from $410mn to $550mn.

FY21 consensus for EPS growth is 15%.

At 30x forward earnings and no dividend yield, A2M is expensive but the growth metrics remain attractive.

Or start a free thirty day trial for our full service, which includes our ASX Research.