Cimic Group delivered a soft 1H20 result that was below consensus expectations. 1H20 NPAT of A$317mn, down 14% on the same time last year.

Work-in-hand increased to A$38bn and the project pipeline for 2020 and beyond has now increased by 10% to $540bn plus.

CIMIC also announced an agreement with Elliott Advisors (UK) for the sale via a JV for 50% of Thiess, the world’s largest mining services provider. Providing joint control of Thiess to CIMIC and Elliott.

The transaction will help strengthen the CIMIC balance sheet and provide flexibility for CIMIC to resume a share buyback next year.

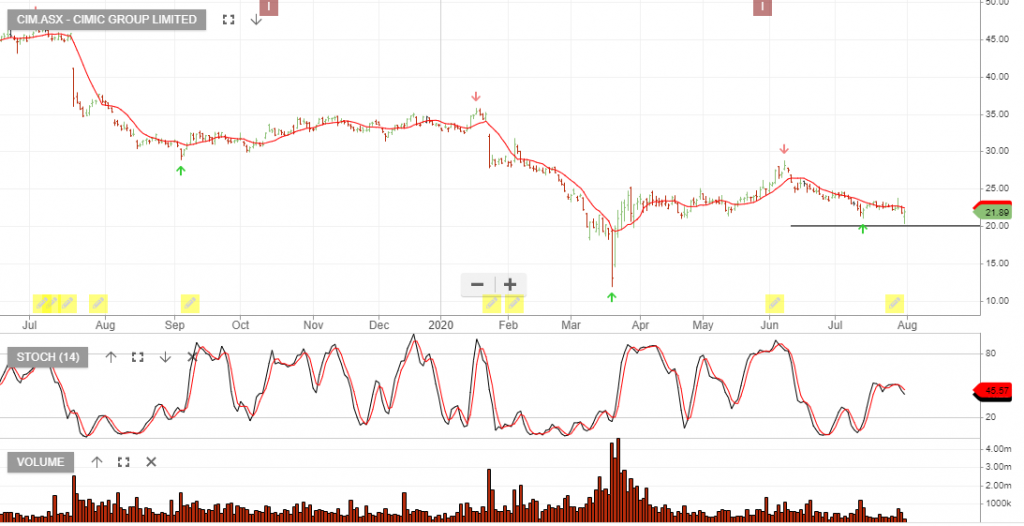

We see value at $21 – $22 per share.