30U.S. corporations repurchased more than $5.1 trillion of their stock since 2010 according to S&P Global.

This share buyback activity happened nowhere else in the world anywhere even close to the scale that we have seen in the U.S.

With the S&P500 still trading at historically high valuations in face of economic weakness, corporate defaults & bankruptcies, discounted capital raisings, it’s likely the market requires a lower valuation range to consolidate within.

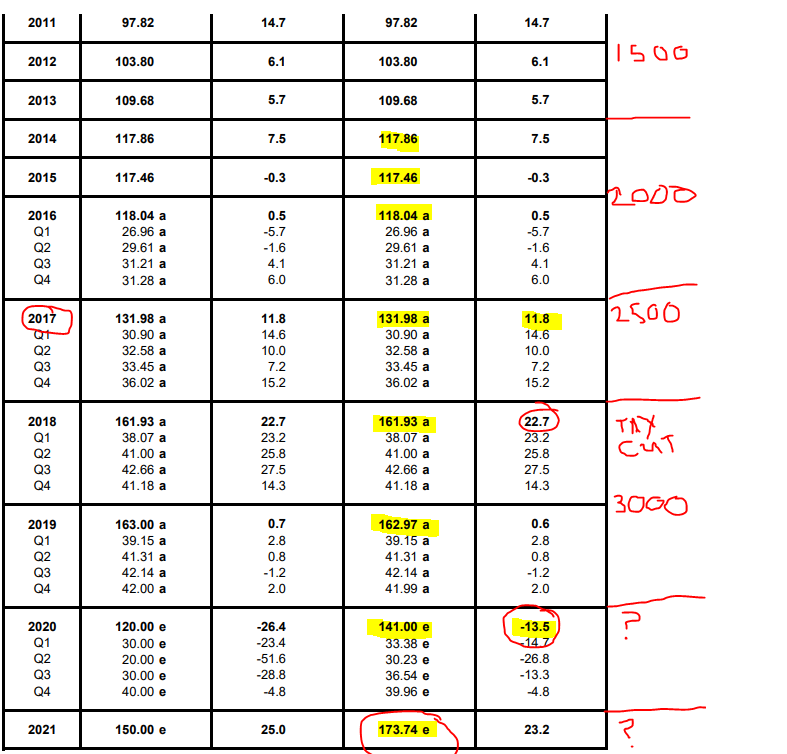

The table below helps link EPS ranges with where the S&P500 should be trading.