Woodside – Buy Signal

Woodside Petroleum is under Algo Engine buy conditions and is a current holding in our ASX 100 model portfolio.

We see price support developing near the $32 level, supported by a 5% yield.

Woodside Petroleum is under Algo Engine buy conditions and is a current holding in our ASX 100 model portfolio.

We see price support developing near the $32 level, supported by a 5% yield.

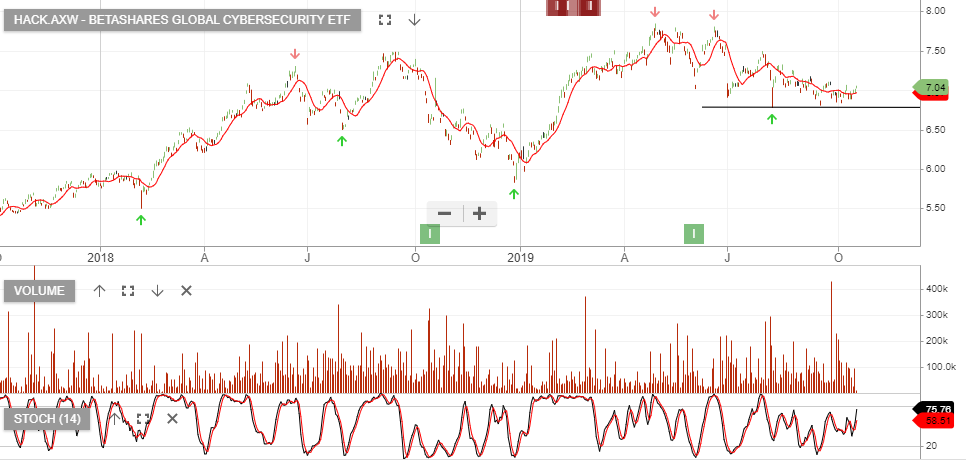

Betashares Global Cybersecurity is under Algo Engine buy conditions and is a current holding in our All ASX ETF model portfolio.

We see support building at $7.00 and expect 5 to 10% upside in the next 6 weeks.

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

Australia and New Zealand Banking Group is a current holding in our ASX 100 model portfolio.

Pressure from lower interest rates more than offset mortgage repricing benefits for the banks and we’ve seen 10%+ correction across the sector.

ANZ, WBC & NAB remain our preferred exposures and we highlight the buying opportunity which is approaching for ANZ.

Buy ANZ within the $25 – $26 price range.

BHP Group is under Algo Engine buy conditions and is a current holding in our ASX 100 model portfolio.

We recommend buying BHP.

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

As the gold price finds buying support our basket of preferred names, Northern Star Resources, Evolution Mining, Newcrest Mining and Vaneck Vectors Gold Miners are among the best percentage performers today.

We continue to like Northern Star Resources as our main gold play.

Australia and New Zealand Banking Group are the first of the big four banks to report annual profits. There was not much to like in the result, Net Interest Margin pressure along with headwinds on cost control, means the outlook was downbeat.

Macquarie Group’s first-half result is due today and it has guided the 2019-20 profit will be “slightly down” on 2018-19.

The market is certain of a dividend cut at Westpac, which reports November 4.

UBS has warned the second-half of 2018-19 will be remembered as the “high watermark” for the sector, ” as the outlook deteriorates in an ultra-low rate environment.

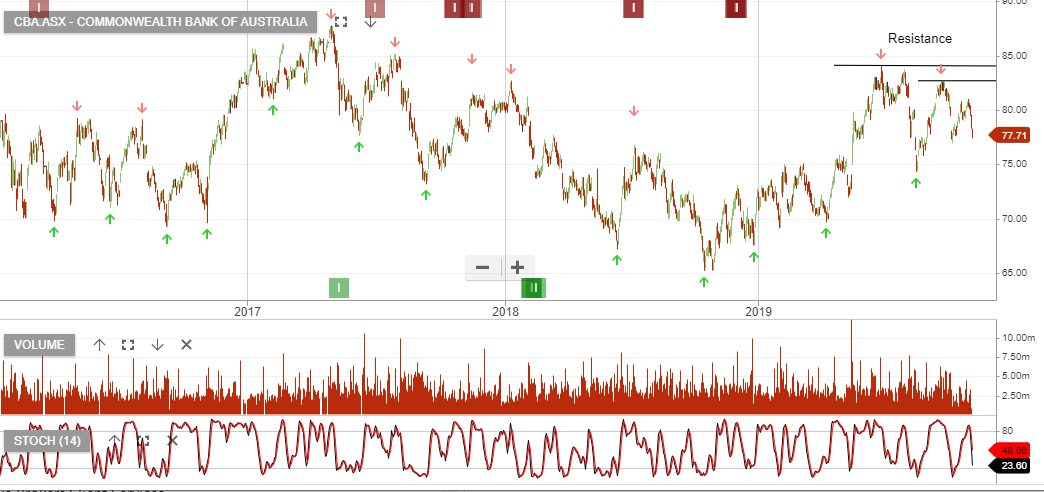

We prefer the short side of CBA.

Or start a free thirty day trial for our full service, which includes our ASX Research.