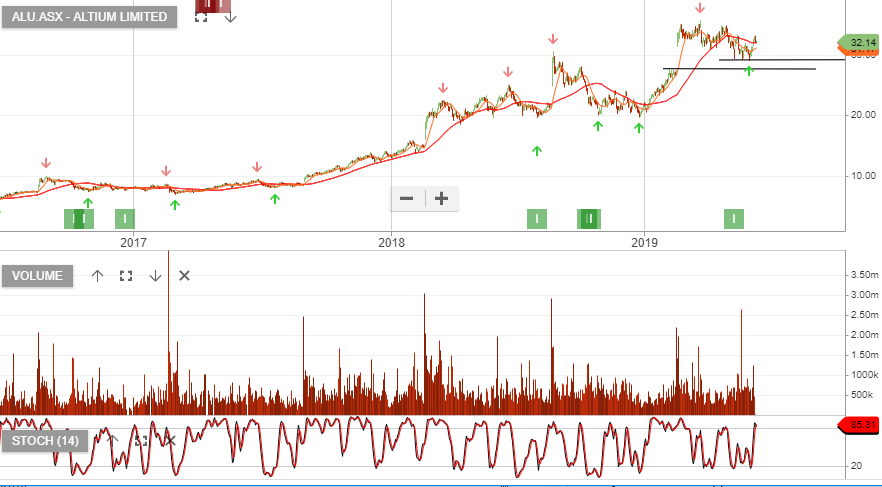

Altium is under current Algo Engine buy conditions and the positive price momentum and recent inclusion into the ASX 100 index, has us digging a little deeper into the fundamentals.

The stock trades at a lofty PE valuation of 56x forward earnings. However, the company has a strong track record of above average EPS growth. FY20 the market is looking for EPS to increase 20% from $0.41 to $0.50 cents per share. FY20 revenue is forecast to jump from $175m to $215m .

The stock currently trades on a dividend yield of 1%.

We’re comfortable to view this as a momentum play and remain long the stock whilst it trades above our $29 stop loss.