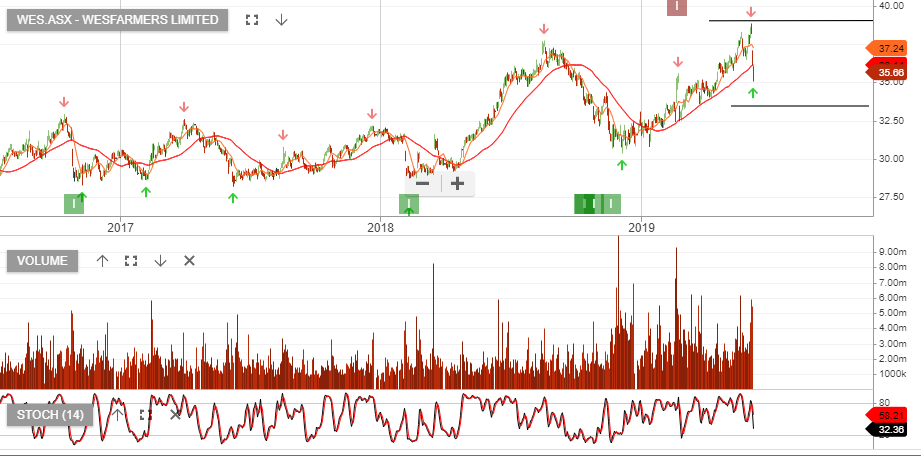

Wesfarmers is currently under Algo Engine sell conditions and the recent sell-off from $38.80 may soon see a new buying opportunity emerge.

The market is in the process of repricing Wesfarmers, following tougher trading conditions, which were highlighted during the strategy day presentation.

The earnings update included downward guidance to the department store division and general headwinds across a number of the Wesfarmers businesses. Investors also need to consider the supply chain investment and system upgrades, as capex spending is set to increase.

We anticipate an overreaction to the sell side and therefore, a buy opportunity may soon approach. Keep Wesfarmers on your radar and watch for the next Algo Engine buy signal.

Wesfarmers trades at 21x earnings and on a 4% yield. EPS growth should remain around 4 -5% and we see support for the share price at $34.00