CBA reported their 1H19 earnings today and the number was slightly below market consensus. The miss was attributable to greater-than-expected margin pressure in their home loan book and costs in insurance.

Revenue came in at $12.4bn and pre-provision cash earnings at 7.1bn.

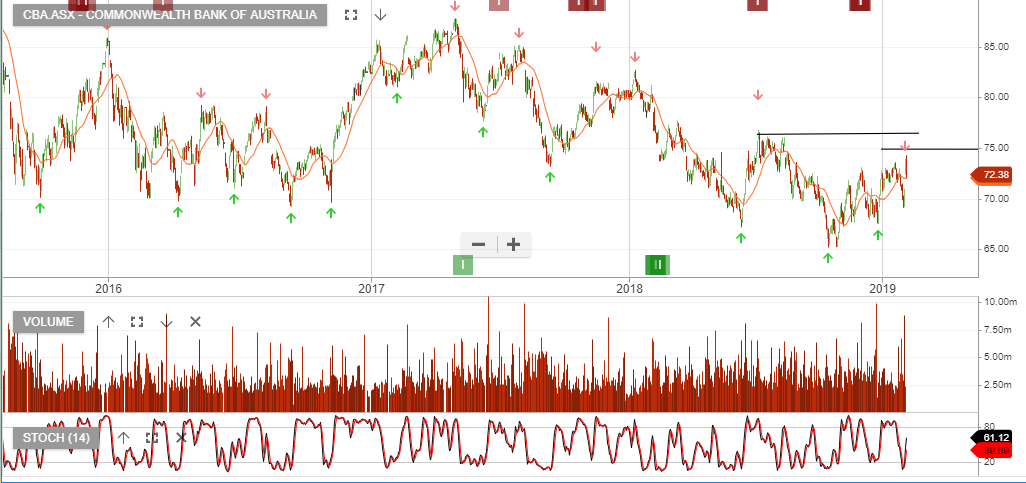

CBA is under Algo Engine sell conditions. The only one of the 4 majors, currently displaying a buy signal and held in our ASX model portfolio is ANZ.

CBA goes ex-div on the 14th of Feb $2.01 which places the stock on a 5.9 yield.