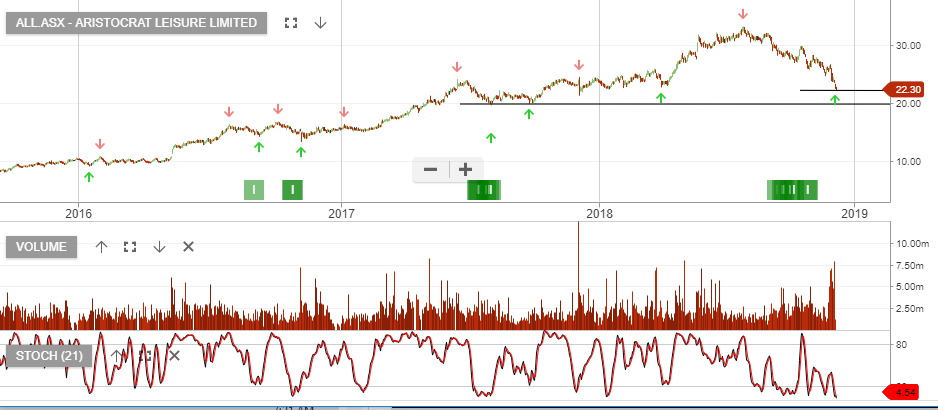

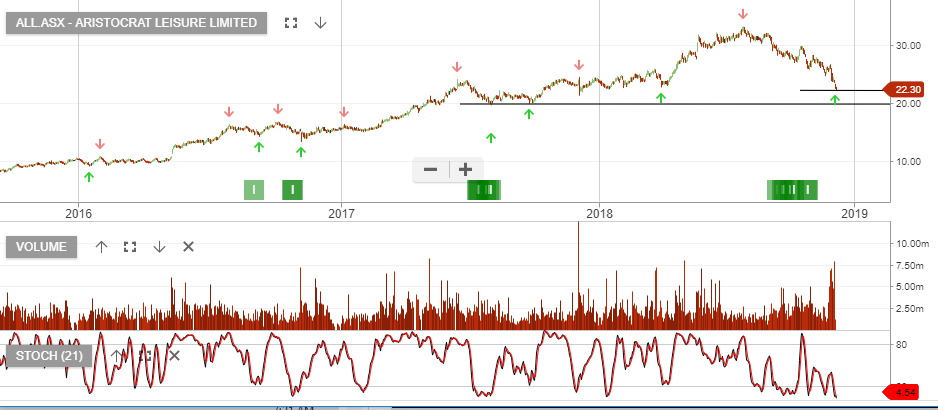

Aristocrat – Approaching Support

Aristocrat is under Algo Engine buy conditions and we see support building between the $20 – $22 level.

We recommend watching the short-term momentum indicators for a reversal higher, within the indicated range.

Aristocrat is under Algo Engine buy conditions and we see support building between the $20 – $22 level.

We recommend watching the short-term momentum indicators for a reversal higher, within the indicated range.

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

Our Algo Engine generated a buy signal in Woolworths back in September and with stock now retracing from the recent highs, we see a buying opportunity at $28.00.

Adding a covered call option, combined with the dividend stream will generate 10% annualised cash flow return.

To learn more about covered call options, please call our office on 1300 614 002.

Note: WOW now trades at 21x earnings and COL is trading on 16x FY20 earnings.

We suggest adding Healthscope, Ansell and Sonic Healthcare to your portfolio.

Healthscope is supported by a pending takeover offer at $2.44 per share. Due-diligence is currently taking place and we expect to hear further news on the takeover in the coming weeks.

HSO – Buy at $2.20

Ansell – Buy at $21.50 & sell covered call options

Sonic Healthcare – Buy at $22.00 & sell covered call options

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

Utilities, REITs and consumer staples continue to provide a defensive area to consider buy write strategies.

AGL, TCL, SYD, GPT & WOW are now pushing recent highs and investors should consider selling covered calls to enhance the income return.

The graph below shows the SLF, (ASX 200 Listed Property Fund), is now up 7% from the October low.

Our preference among the gold names are EVN and NST, following the recent Algo Engine buy signals.

Both are current holdings in the ASX 100 model portfolio.

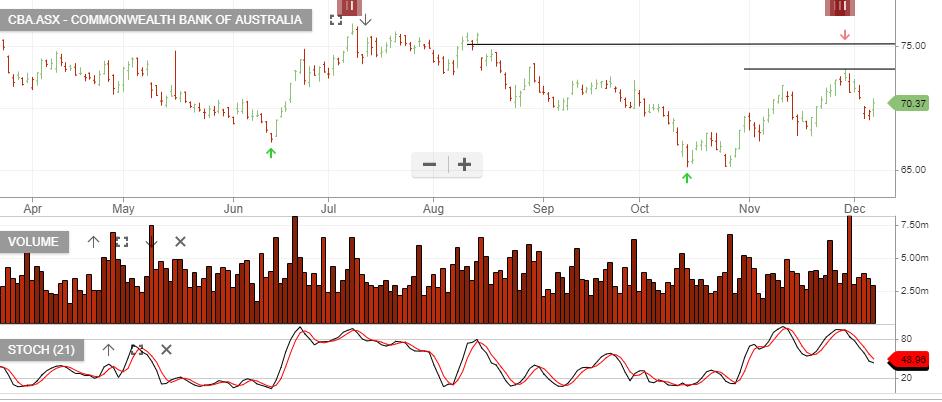

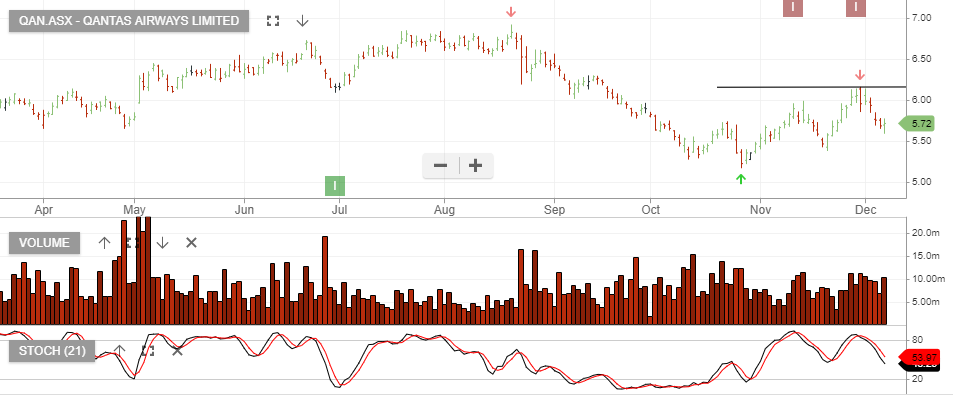

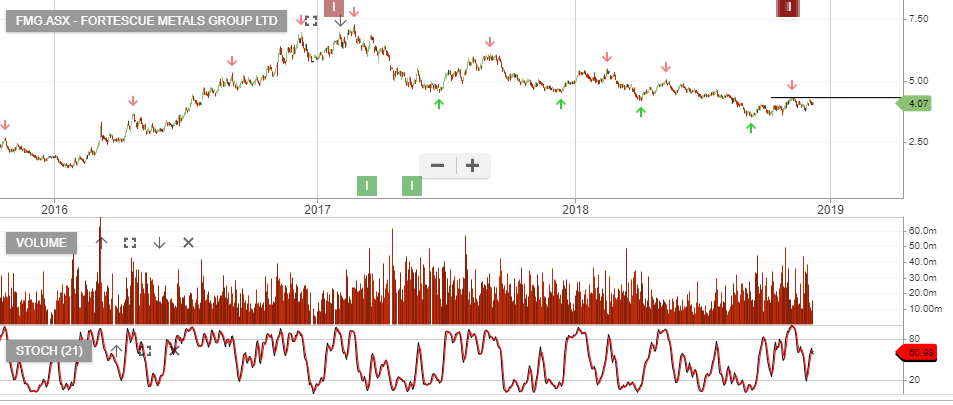

The following group of stocks are short signals where we see further downside.

OZL, QAN, ORI, FMG, CBA and HVN.

A rebound in energy prices in Friday’s US trading session will place added pressure on Qantas, come Monday morning.

Structural issues with the HVN business model and weak consumer spending will weigh on the share price.

Both FMG and RIO now have lower high formations and Algo Engine sell signals.

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

AGL, SYD and TCL are now displaying Algo Engine sell signals. With global bond yields moving lower, (in recent weeks), yield sensitive names have generally outperformed.

The rally in AGL, SYD and TCL now represents full value and investors should look to take profit or sell covered call options.

Or start a free thirty day trial for our full service, which includes our ASX Research.