Unibail-Rodamco-Westfield is the premier global developer and operator of flagship shopping destinations, with a portfolio valued at €63.7 Bn, (as at 30 June 18).

86% of the portfolio is in retail, 8% in offices, 5% in convention & exhibition

venues and 1% in services.

Currently, the Group owns and operates 97 shopping centres, including 56 flagships in the most dynamic cities in Europe and the United States. Its’ centres welcome 1.2 billion visits per year. Present on 2 continents and in 13 countries.

The Group has the largest development pipeline in the industry, worth €12.5 Bn.

Unibail-Rodamco-Westfield stapled shares are listed on Euronext Amsterdam and Euronext Paris (Euronext ticker: URW), with a secondary listing in Australia through Chess Depositary Interests.

The Group benefits from an A rating from Standard & Poor’s and from an A2 rating from Moody’s.

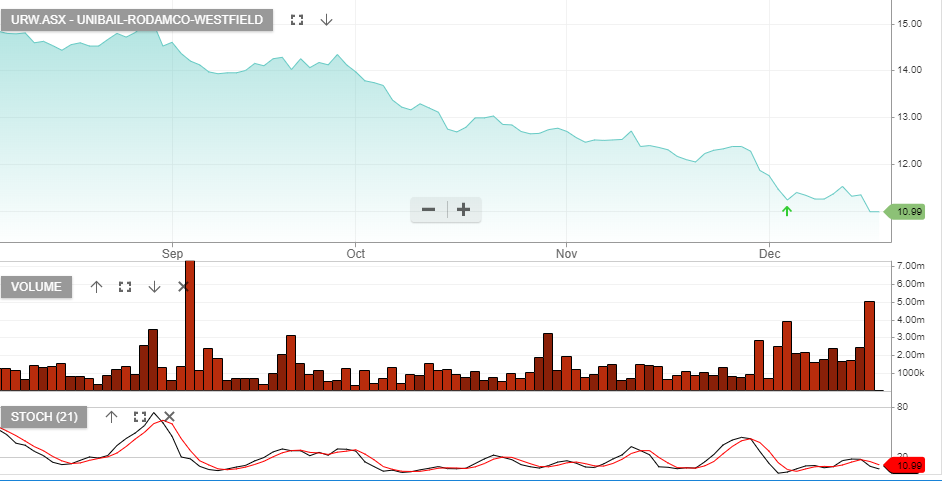

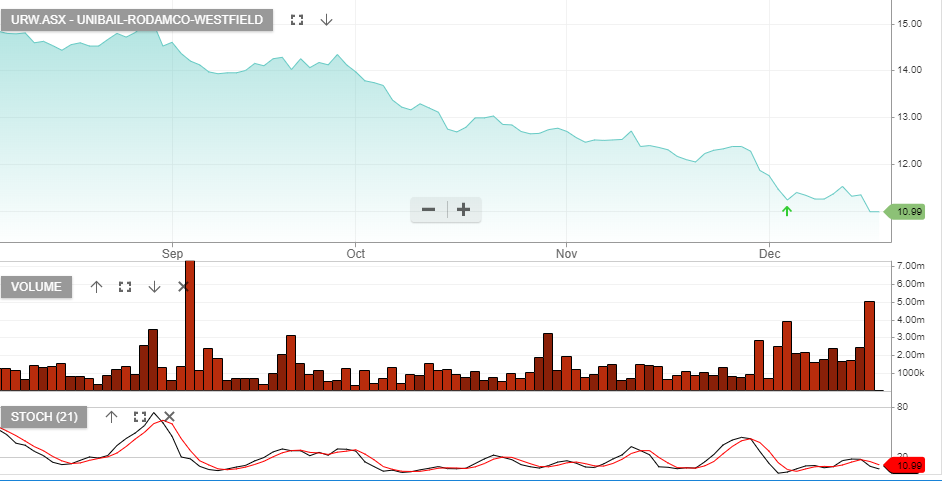

After selling Unibail at $14.50 per share, immediately following the takeover in June, we now have this name back on our radar.

NOTE: Further to an agreement entered into in October 2018, Unibail-Rodamco-Westfield announces the completion of the disposal of the Tour Ariane office building, located in the heart of La Défense business

district, (Paris region), to Singapore’s sovereign wealth fund GIC. The Net Disposal Price of the transaction is €464.9 million.