Last month Healthscope’s shares jumped as much as 22% to $2.17 on the news BGH Capital-AustralianSuper consortium will offer $2.36 cash per share as an indicative takeover price.

Since then, HSO shares have settled back at $2.05 – $2.10 and we feel value is now on offer and investors should look to accumulate the stock.

Healthscope runs 43 private hospitals across Australia and 24 pathology laboratories in New Zealand.

In May, Healthscope refused to open its books to a prior takeover offer, instead, saying they’ll look into the sale and lease back of its hospital assets.

Pressure is now mounting on the HSO board of Directors to engage and allow the acquiring entity access to the data rooms and due-diligence process.

NOTE: This morning a competing bid has been announced, Brookfield Capital has now Offered $245.5 per share.

Healthscope

‘

‘

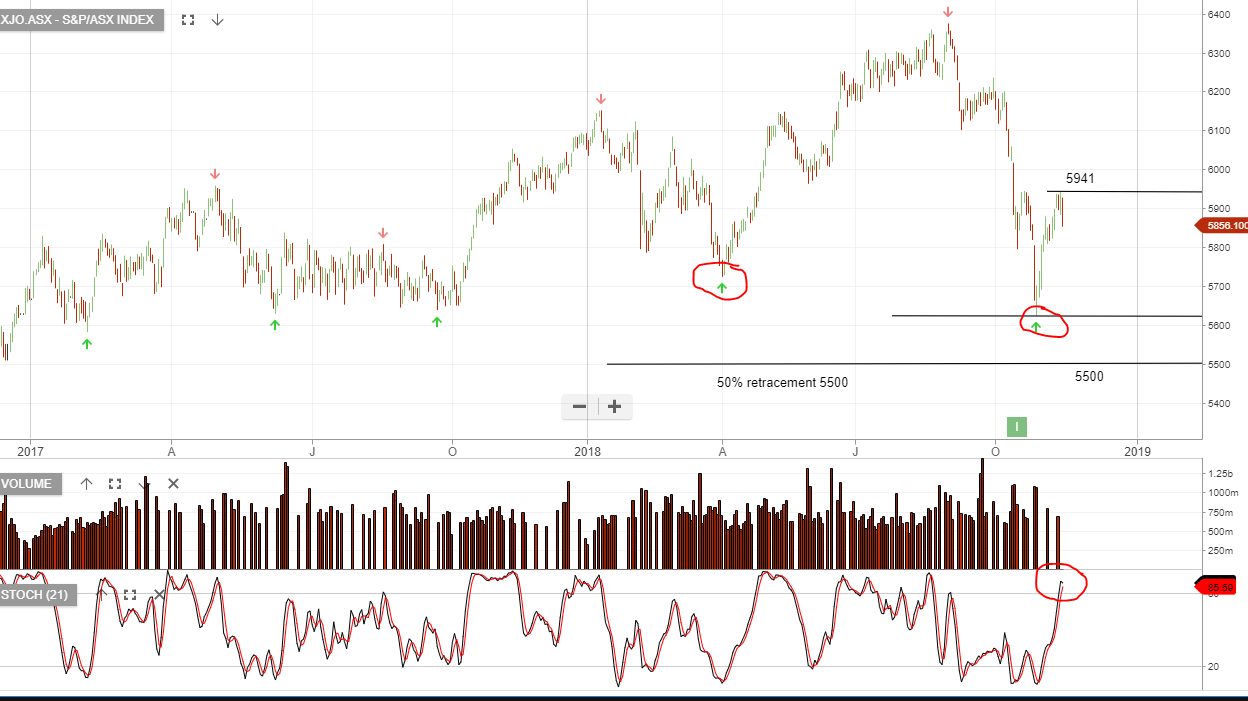

XJO Index

XJO Index Northern Star

Northern Star Evolution Mining

Evolution Mining