Buy Crown Resorts

Crown is a current holding within the ASX100 model portfolio.

The share price was oversold at $11.50 and we’re now starting to see buying interest build.

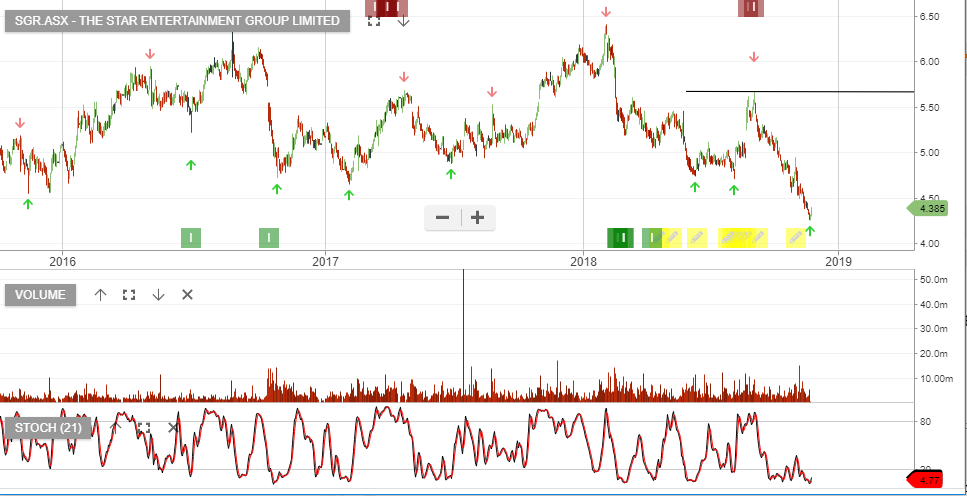

Also, consider SGR with stop loss below recent pivot low.

Crown is a current holding within the ASX100 model portfolio.

The share price was oversold at $11.50 and we’re now starting to see buying interest build.

Also, consider SGR with stop loss below recent pivot low.

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

Shares of SEK have extended this week’s gains and have reached a two-week high of $18.55 in early trade today.

The online job search engine has been under an ALGO buy signal since August and is part of our ASX Top 100 Model Portfolio.

We consider much of the recent downside price action technical in nature and see solid chart support in the $17.50 area.

The next key resistance level is near $19.60 with a longer-term target above $20.25.

SEEK

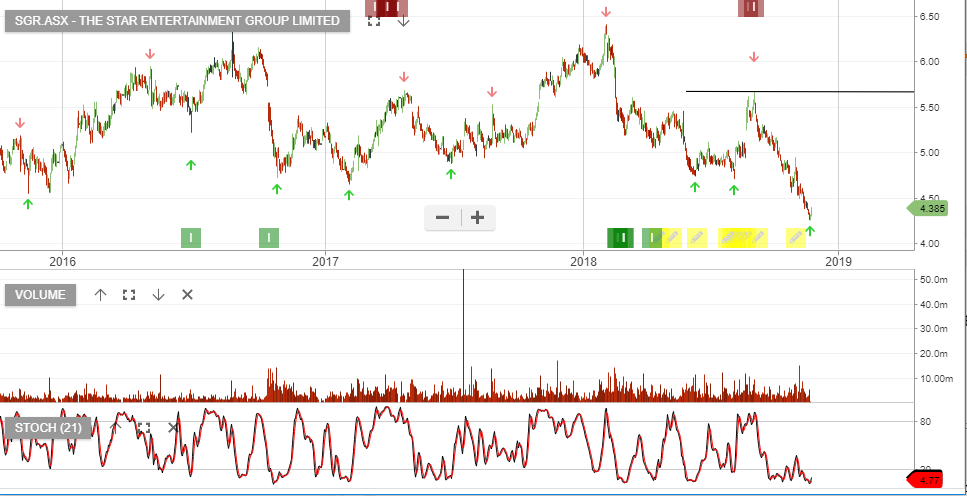

CAR is one of the “GARP” (growth at a reasonable price), names that we’ve been tracking.

With the stock bouncing off the $11.00 price level, we suggest running a tight stop-loss below the recent “pivot low” and giving the upside momentum a chance to develop.

Within the back drop of market volatility, it is difficult to know how this trade plays out in the short-term. Therefore, we highlight the need to run a stop loss.

We consider ALL & TWE as similar technical opportunities.

Carsales.com

Our Algo Engine recently generated a buy signal in BHP and with the share price retracing back to $32, (following the sell-off in oil), we recommend investors accumulate the stock.

BHP trades on a forward yield of 5.2%, allowing for a 20% lift in FY19 earnings.

BHP

Sorry, but this content is restricted to our members.

Please login with your account or register for a free trial. If your trial has expired, then you may renew it here.

If you are having an issue with your account, then please get in touch with us.

Santos has a price gap in the chart at $5.25 and we’re looking for buying support to build at or slightly above this level.

Santos

Since posting an all-time high close at $19.85 on September 3rd, the share price of TWE has dropped over 30% reaching a 12-month low of $13.40 in early trade today.

This selloff has come despite the fact that the company has maintained their guidance for EBITS growth of 25% going into 2019.

Technically, the momentum indicators have reached an oversold level last seen in January of this year, which preceded a 23% rally over the following 2 months.

Treasury Wine Estates

Bluescope has sold off from $19 (mid-year), to now be trading at $12.10. The stock was expensive and we’re now back in fair value range.

The outlook is uncertain as US and Asian steel spreads contract and lower steel prices negatively impact forward earnings.

Also, leading indicators for the domestic residential construction market are creating investor concerns.

We expect cautious outlook comments from the AGM trading update on Friday, 23 November.

Watch for buying interest to build above the $10.50 support level.

Bluescope

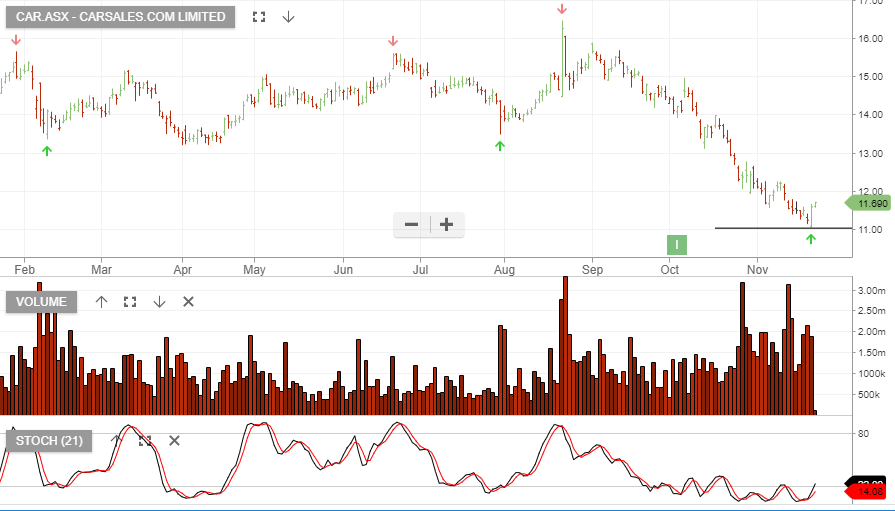

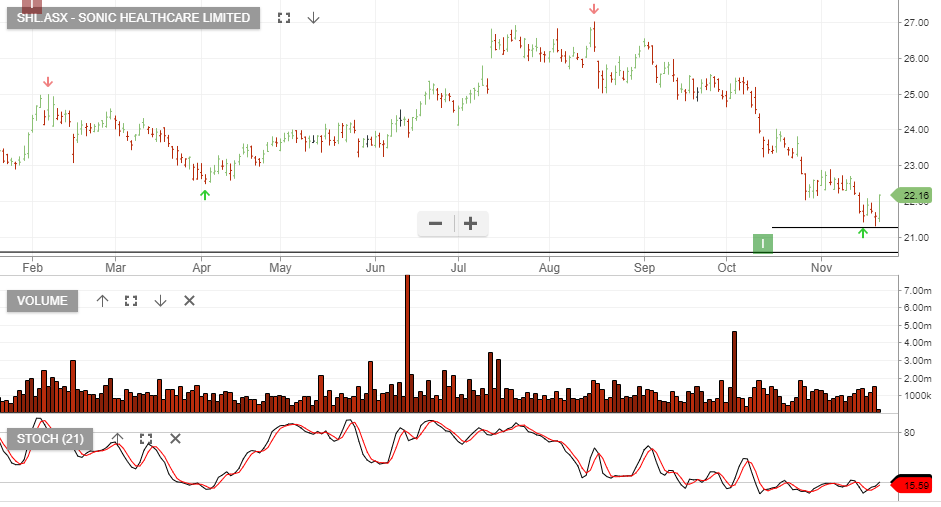

In a volatile market, we continue to like Sonic Healthcare and recommend accumulating the stock with a view towards selling covered call options to enhance the income return.

SHL goes ex div $0.32 on the 6th March. June $23.50 strike call option generates an additional $0.75 per share of income.

Or start a free thirty day trial for our full service, which includes our ASX Research.