Aristocrat Leisure reported a 30% increase in FY18 after tax earnings at A$730m.

The result was slightly below consensus and recent digital acquisitions were offset by lower than anticipated margins in the Americas.

The outlook commentary remains positive and FY19 EPS growth is forecast at 10%+. Aristocrat continues to invest for the future, with an additional $100m identified for digital acquisitions.

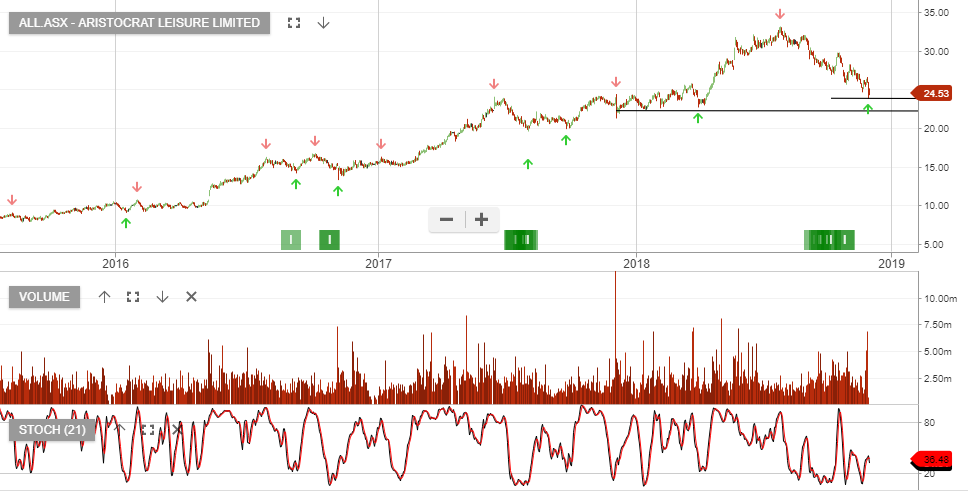

On a forward basis, we have ALL trading on a 2.2% yield into FY19 and we see price support at $22.50

Based on FY20 PE of 18x earnings we can justify an upside price target of $26.00