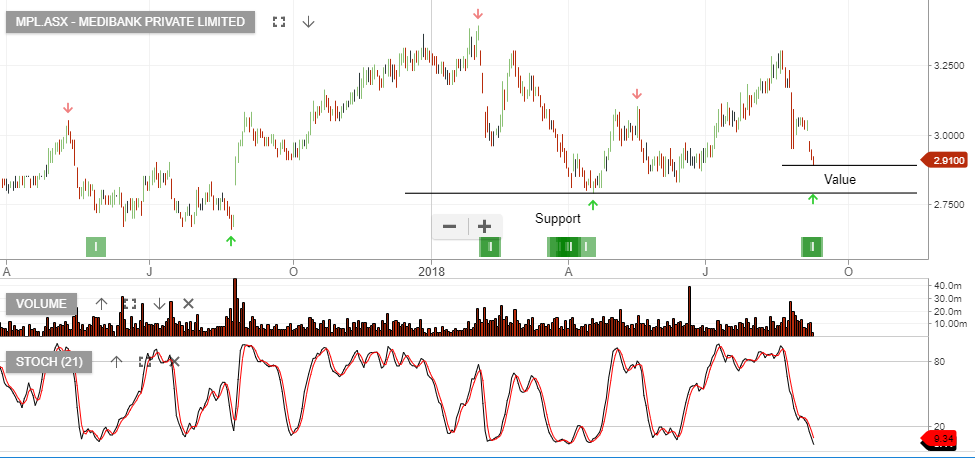

Our Algo Engine generated a buy signal in MPL on Friday.

With the share price retracing from a $3.39 high, (formed in February), to close at $2.89, we now draw your attention to MPL as it enters our value range.

MPL’s earnings report last month showed the company is struggling to grow revenue and bottom line profit, therefore 2019 will likely show flat to no growth.

However, with the stock on a 4.4% yield and adding a covered call option, 10 – 12% annualized cash flow can be generated without too much downside risk.

Look to accumulate within the $2.80 – $2.90 range.