Algo Update – JB Hi-Fi

Strong retail data supports JB Hi-Fi and we believe the share price represent good value over the medium-term .

JBH has gone ex dividend today for 46 cents, which represents a forward yield of 5%.

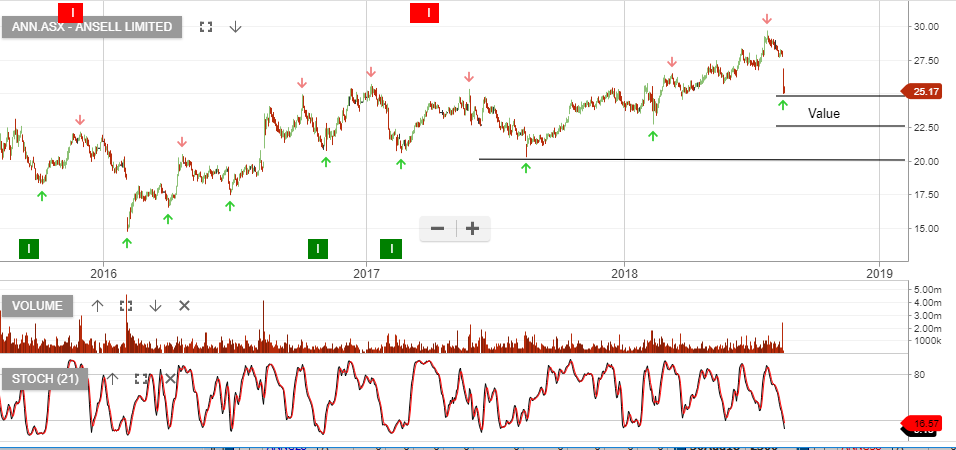

We see solid chart support in the $24.80 to $25.00 range.

JB-HI