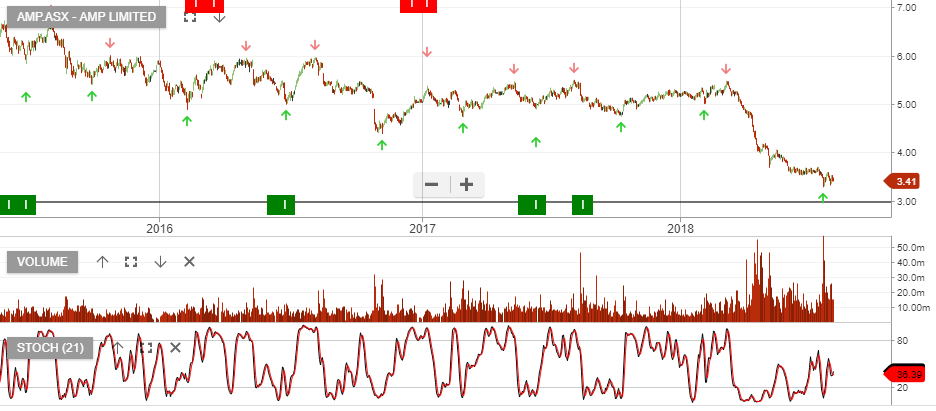

AMP’s 1H18 result was underpinned by effective cost management offsetting

weaker revenue performance.

The Australian Wealth Management division saw net outflows of $673m in the quarter.

Going forward, we expect well managed costs to offset weaker revenue. There is longer-term value here for patient investors, who are willing to hold the stock through to the appointment of a new permanent CEO.

In 2019, AMP’s board will likely outline a plan to split the funds management business away from the traditional advice side model, unlocking value for shareholders.

We have AMP now trading on a 6.8% yield and expect FY19 reported profit to remain around $800m.

AMP