The Big four banks will be in the spotlight this week as the Banking Royal Commission commences round five today in Sydney.

The main topic for this round of examination will be the fees, charges and weak performance of bank-managed superannuation funds.

One Melbourne-based think tank has estimated that excessive fees and poor performance can cost superannuation investors up to $12 billion per year.

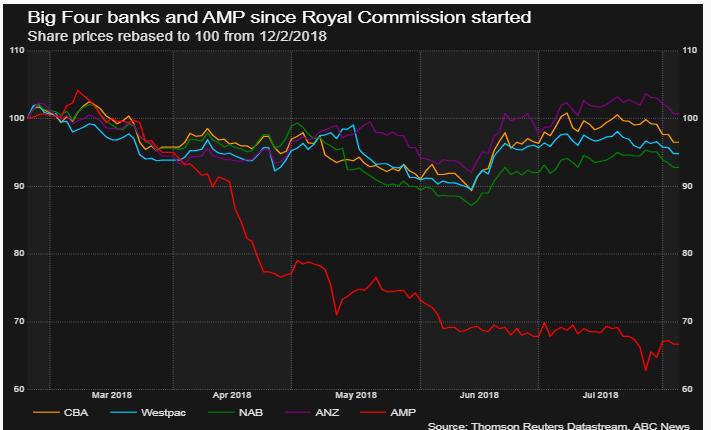

Australia’s largest superannuation provider, AMP, felt the wrath of the Royal commission during the last round of testimony, which saw their share price drop over 30% and the sacking of its chairman, CEO and three other directors.

The chart below illustrates the performance of AMP’s share price relative to the other Big 4 banks.

We don’t have ALGO buy signals for any of the domestic banks and we’re not holding any banking names in our ASX Top 100 portfolio. However, we will look for signals as the share prices approach the June lows.