Telstra Firms In Front Of Next Week’s Investor Day

Since posting an intra-day low of $2.74 on Wednesday, shares of Telstra have risen over 8% and are pushing against $3.00 in early trade today.

We cite two fundamental catalysts for the renewed buying interest in the telco giant.

First, the acquisition of Time Warner by ATT in the US has supported the idea of global telecommunication firms increasing revenue by diversifying into media and entertainment.

Second, TLS will be hosting its highly anticipated investor day next Wednesday, June 20th.

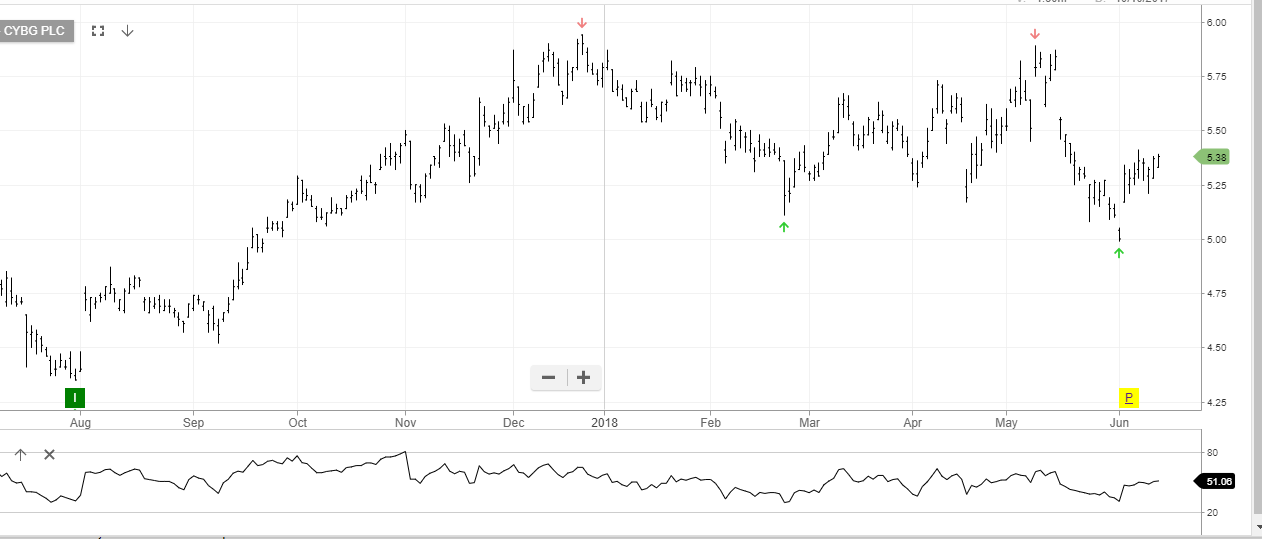

CYB

CYB