The NAB result was subdued with revenue growth deteriorating. 1H18 NPAT $2.75bn down 17%, EPS 99cps and Div 99cps.

“looks like a dividend cut is imminent”

1H18 revenue rose just 0.7%, whilst Net Interest Income fell and loan growth was anemic at +1%.

In both the ANZ and NAB results, we’ve seen early signs of bad and doubtful debts, (for 90 days+), beginning to rise from very low historical levels.

Lower loan growth, no revenue growth, increased costs associated with restructuring, competition from technology disruptions, increasing bad debts, wafer-thin bad loan provisioning are reasons to “sell the rally” in the banking shares.

6100 – 6200 on the XJO Index should be a level to review bank holdings.

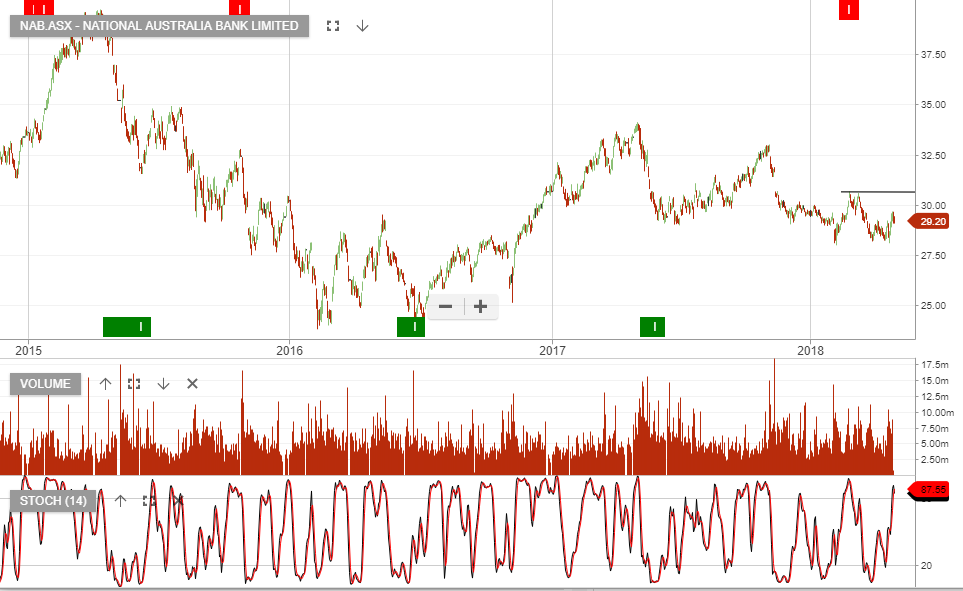

NAB