Shares of NAB are down over 1.5% in early trade as the bank reported a 16% drop in half-year cash profit as it booked a restructuring-linked costs related to workforce reduction.

The bank posted cash earnings, that excludes one-offs and non-cash accounting items, of $2.76 billion for the six months ended March 31, compared with $3.29 billion last year.

NAB bank maintained its interim dividend at 99 cents per share, which puts it on 13.2 times earnings.

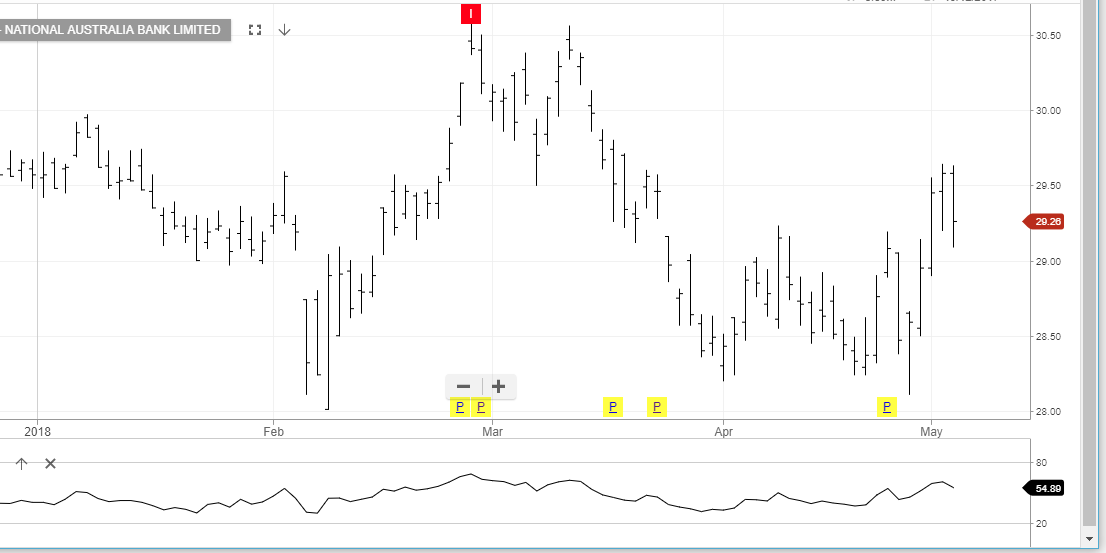

Our ALGO engine triggered a sell signal for NAB on February 27th at $30.40.

The technical picture is fairly neutral, and with NAB going ex-dividend on May 16th, we see initial support in the $28.50 area.

NAB