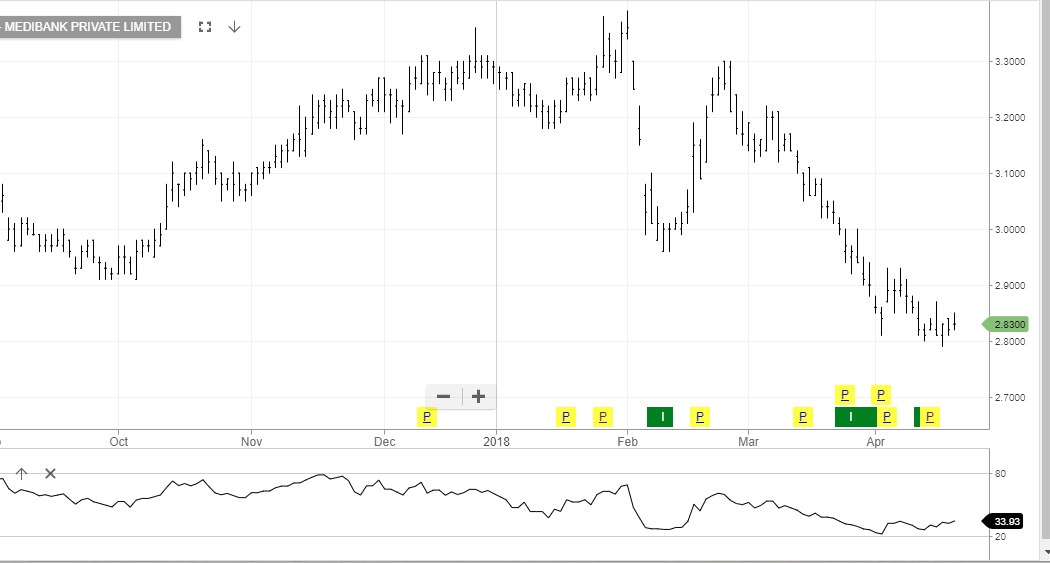

Since trading as high as $3.25 a month ago, the share price of MPL has dropped over 13% to hit an 8-month low of $2.79 this week.

There have been several market reports citing increased political pressure for lower premiums and lower profits for domestic health care providers.

MPL reported a first-half net profit of $245.6 million in February, up 5.9% from the previous corresponding period with an interim fully-franked dividend of 5.5 cents per share, 4.8% higher than the previous corresponding period.

Our ALGO engine triggered a buy signal on MPL at $2.81 on April 13th.

We suggest buying MPL at current levels as a “buy/write” strategy. More specifically, looking to sell $3.00 Call options into December for 10 to 12 cents.

This will allow for some capital appreciation and investors will collect the 6.75 cent dividend on September 6th.

Medi-Bank Private