Even though the US Stock market has stabilized over the last week, the US Treasury curve continues to flatten.

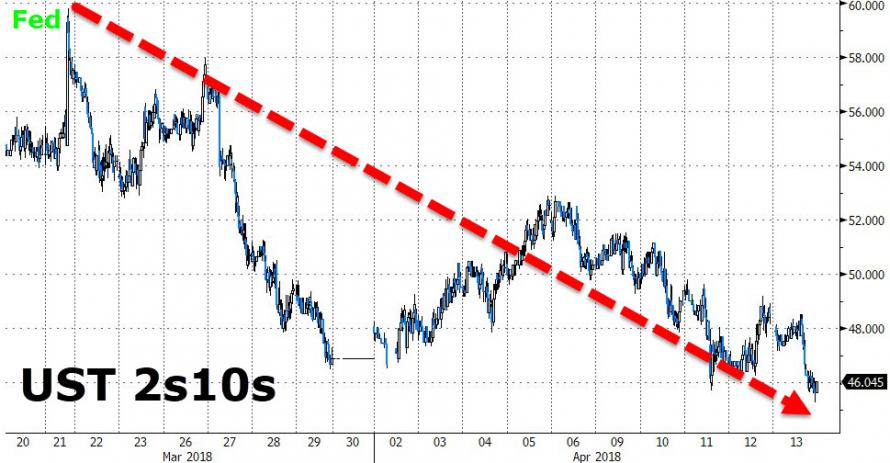

As illustrated in the chart below, the difference between the US two and 10-yr bonds has now dropped to 46 basis points (2.36% vs 2.82%).

This is the first time since 2007 that this spread has narrowed below 50 basis points, and, in the past, has been a level which has foreshadowed recessionary pressure.

It’s our base case that the bulk of the curve flattening has been a result the two-yr yields rising quickly and the longer dated yields trading sideways to lower.

In this respect, we would expect some of the local yield names to find some buying support this week.

Some of the stocks we prefer include; TCL, SYD, WFD, AMC and GPT.

For more information about how to trade the US yield curve, call our offices on 1-300-614 002

2-yr versus 10-yr yield spread

Transurban

Sydney Airport

Westfields