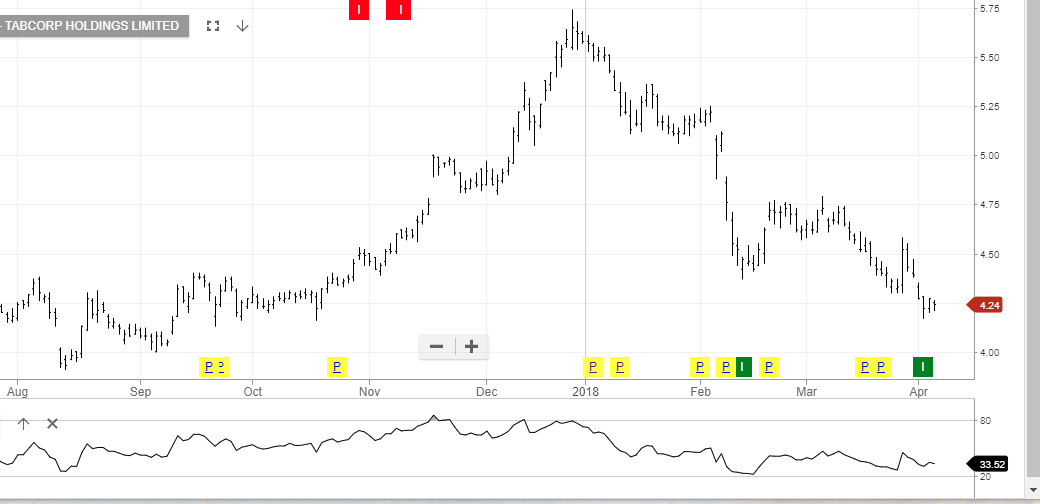

Our ALGO engine triggered a buy signal for TAH into yesterday’s ASX close at $4.22.

This “higher low” pattern is referenced to the $4.16 low posted on October 18th, 2017.

Since the company last reported earnings in February, the share price has dropped over 20%.

Technically, the price has reached oversold territory. Fundamentally, we feel investors are currently overlooking the cost savings of the newly merged company.

We believe TAH represents good value at in the $4.25 area and that shares will rally into the next earnings report scheduled in August.

TAH will also pay a 12.5 cent dividend in August, which pencils out to a 5.9% annual yield.

Tabcorp