U.S. Retail Sales fell for a third straight month in February as households cut back on purchases of motor vehicles and other big-ticket items, pointing to a slowdown in economic growth in the first quarter.

Consumer spending, which accounts for more than two-thirds of U.S. GDP, appears to have slowed at the start of the year.

The combination of weak consumer spending data and global manufacturing data has been enough to see yields run into resistance.

The peak optimism on synchronized global growth and inflation pick-up, now appears to have passed.

With yields moving lower, we’re likely to see a better environment for the yield sensitive sectors. Telecommunications, Utilities, Consumer Staples and Real-Estate.

Some of the local names in these sectors include: SYD, TCL, AGL, GPT, SCG and WFD.

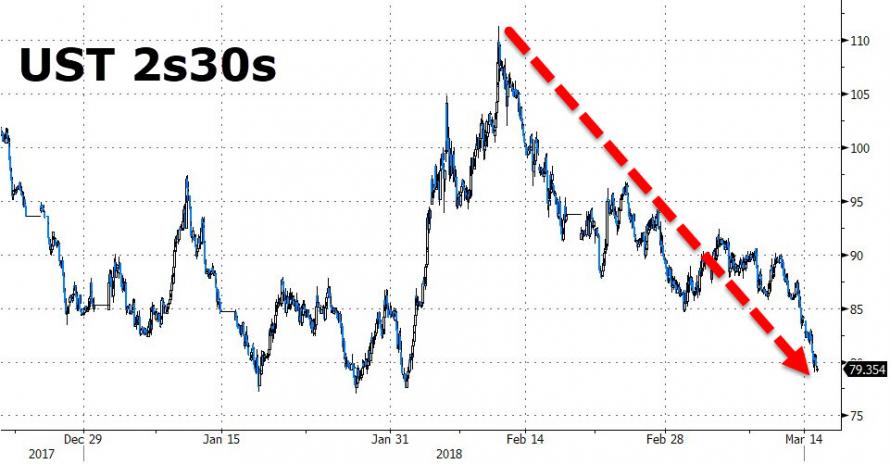

The chart below illustrates the yield on the 30-yr bonds falling relative to the shorter dated 2-yr bonds. This is typical during a period of slower economic growth.